Preparing for Retirement

Select a country below to read the localised content of this article.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement. However, planning for your retirement and deciding whether to transfer a pension from one plan to another can be complex. If you are unsure, then you should seek advice from a Financial Adviser. You can find details on how to find a financial adviser on the Financial Conduct Authority website by visiting: https://www.fca.org.uk/consumers/finding-adviser

Making sure you have financial freedom to enjoy life

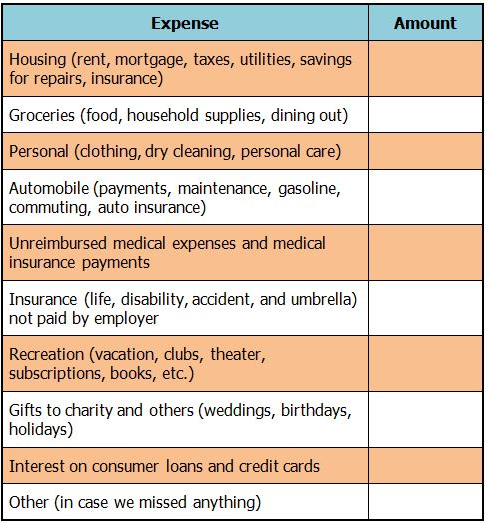

- It's easier to plan when you've worked out what you need to live on and how much retirement income you'll have.

- Write down the ‘net' (amount after tax) monthly income that you expect to receive from your personal pension(s), state pension and other savings and investments that you may have.

- Compare this amount with the outgoings you think you might have when you retire.

- Consider that your any commuting expenses may reduce when you no longer travel to work. If you have an interest-only mortgage, you will need to repay the capital sum at the end of the mortgage term. Also, it's possible that your household bills may increase when you're no longer working and instead spending more time around the house.

- If you have more than one pension it might make sense to combine them into a single plan. Not only can consolidation save you charges, it could give you a much clearer picture of how much you've saved and how much income you're likely to get when you retire.

- With a larger pension fund, you may also find your investment options widen and you may be eligible for larger-fund discounts.

- When you're ready to convert your pension fund into a retirement income, a single larger pension fund may also provide you with more choices. For instance, some retirement income options may only be appropriate for people with larger pension funds.

- Some pensions have generous benefits that you might lose out on if you consolidate. For instance, with the extra benefits and value for money with final salary schemes it could make more sense to leave them where they are.

Understanding my retirement options

- You can usually take up to 25% of your pension fund as a tax-free lump sum, to spend, save or invest. The more you take as a lump sum, however, if you spend it, the less you'll have available as a regular retirement income.

- If you want a guaranteed, regular income for the rest of your life, an annuity could be right for you. You can use your whole fund to buy an annuity - or, you could take a tax-free lump sum from your pension fund and use the rest to buy an annuity.

- Or you may decide that you wish to take a fixed term annuity to provide you with an income amount of your choice for a specific time period before selecting a retirement option at the end of that fixed term.

- For more flexibility, a drawdown pension lets you take income from your pension, while the balance of your fund stays invested and continues to benefit from any potential growth. Keep in mind – your pension would remain invested and the value of your investments can go down as well as up and you might not get back what you paid in.

- You may decide that you wish to take the whole fund as a cash lump sum. The first 25% of your fund will be tax-free while the remaining 75% will be taxed at your marginal rate of tax (20%, 40% or 45% as applicable).

- You may need to consider alternative ways of boosting your income. For example, you could consider working part time or downsizing to a less expensive home.

The content of this article does not constitute individual financial advice.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

- It's easier to plan when you've worked out what you need to live on and how much retirement income you'll have.

- Write down the ‘net' (amount after tax) monthly income that you expect to receive from your personal pension(s), state pension and other savings and investments that you may have.

- Compare this amount with the outgoings you think you might have when you retire.

- Consider that your any commuting expenses may reduce when you no longer travel to work. If you have an interest-only mortgage, you will need to repay the capital sum at the end of the mortgage term. Also, it's possible that your household bills may increase when you're no longer working and instead spending more time around the house.

- If you have more than one pension it might make sense to combine them into a single plan. Not only can consolidation save you charges, it could give you a much clearer picture of how much you've saved and how much income you're likely to get when you retire.

- With a larger pension fund, you may also find your investment options widen and you may be eligible for larger-fund discounts.

- When you're ready to convert your pension fund into a retirement income, a single larger pension fund may also provide you with more choices. For instance, some retirement income options may only be appropriate for people with larger pension funds.

- Some pensions have generous benefits that you might lose out on if you consolidate. For instance, with the extra benefits and value for money with Defined Benefit schemes it could make more sense to leave them where they are.

Understanding my retirement options

Your options at retirement may include:

- Taking a tax-free lump sum, subject to limits set by Revenue;

- Receiving a pension (sometimes provided by an annuity);

- Transferring some or all of your retirement savings to an Approved Retirement Fund (ARF) or Approved Minimum Retirement Fund (AMRF);

- taking a taxable lump sum; and

- Providing for dependants.

You may need to consider alternative ways of boosting your income. For example, you could consider working part time or downsizing to a less expensive home.

The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy. Current life expectancy is 83 years for men and 88 for women, which will translate to 18 and 23 years respectively in retirement, assuming retirement age is 65-years-old. What happens if you live beyond that?

Spending on health will also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health will increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Rome was not built in a day, just like retirement planning. Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, the best time is to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

Imagine this, Adam saves $200 per month for 10 years at a high interest savings account of 5%, he will end up with $30,186.94 with $24,000 being his capital. And now we have Brian who starts saving 5 years later, but saves double the amount that Adam does, $400 per month for 5 years with the same interest, he will end up with $26,523.03, with $24,000 being his capital. Although both have put in the same amount, at the end of the day, with effects of compounding interest, the difference becomes amplified.

There are several options available that can assist you in reaching your retirement goals such as CPF Life (For Singaporeans and Singapore Permanent Residents (SPRs) only), annuity insurance plan as well as investments options and there is no one perfect solution that is able to suit your retirement needs. Therefore, it is important to understand how they can fit into your retirement planning and with proper advice and guidance, you are on your way to have your retirement secured before it comes.

Disclaimer: The information is brought to you by Aon Singapore Pte Ltd, registration number 198301525W. Aon Singapore Pte Ltd is a registered insurance broker and exempt financial adviser regulated by the Monetary Authority of Singapore. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for longer life expectancy. If life expectancy is 83 years for men and 88 for women, which will translate to 18 and 23 years respectively in retirement, assuming retirement age is 65-years-old. What happens if you live beyond that?

Spending on health will also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health will increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Rome was not built in a day, just like retirement planning. Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, the best time is to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

Imagine this, Adam saves $2,000 per month for 10 years at a high interest savings account of 5%, he will end up with $309K with $240K being his capital. And now we have Brian who starts saving 5 years later, but saves double the amount that Adam does, $4,000 per month for 5 years with the same interest, he will end up with $272K, with $240K being his capital. Although both have put in the same amount, at the end of the day, with effects of compounding interest, the difference becomes amplified.

There are several options available that can assist you in reaching your retirement goals such as voluntary MPF contributions, annuity insurance plan as well as investments options and there is no one perfect solution that is able to suit your retirement needs. Therefore, it is important to understand how they can fit into your retirement planning and with proper advice and guidance, you are on your way to realising your retirement dreams.

Disclaimer: The information is brought to you by Aon Hong Kong Limited. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent later. You should always consult primary or more accurate or more up-to-date sources of information.

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of hot coffee and watching them play around, is that how you envision your retirement to be?

Retirement is the ultimate life goal for each one of us. From the moment we start earning our first pay-check to getting married, having a house and setting up our own family, we will eventually reach a stage when we think of finally retiring from work. Certainly, everyone’s retirement needs will be different.

To somehow determine how much you need to save for your retirement, it is important to figure out the lifestyle you envision to live when that time comes. Go over your current monthly budget and imagine how it will look like when you stop receiving that monthly pay anymore. If it is quite difficult to visualize your retirement lifestyle, experts have mentioned that one typically needs 60% to 80% of current income during retirement. In addition, target retirement age as well as life expectancy will also have an impact on your funding. The earlier you intend to retire, the more you will have to set aside. That goes likewise for life expectancy. Current life expectancy for Filipinos is 66 years for men and 72 for women, which will translate to 6 and 12 years respectively in retirement, assuming retirement age is at 60 years old. What happens if you live beyond that?

Spending on health is expected to increase as age-related diseases set in or existing ones incur complications. Hence, there is more reason for you to keep your medical insurance policies and anticipate its premium to increase over the years. Since company provided healthcare coverage is co-terminus with employment, it would be wise to get hold of life insurance policies with medical coverage riders while you are still employed.

Rome was not built in a day, just like retirement planning. Each small step that you take today, contributes to the fund that will support your retirement lifestyle. Needless to say, that it is best to start as early as possible since the later you start saving, the more money you will have to save to reach your desired retirement fund. Moreover, with effects of compounding interest, the difference becomes quite significant.

Imagine this, Maria saves Php 3,000 per month for 10 years at a high interest rate ending up with Php 424,800 with Php 360,000 being his capital. And now we have Peter who starts saving 5 years later, but saves double the amount that Maria does, Php 6,000 per month for 5 years with the same interest, he will end up with Php 392,400 with Php 360,000 being his capital. Although both have put in the same amount, at the end of the day, with effects of compounding interest, the difference becomes amplified.

There are several options available that can assist you in reaching your retirement goals such as variable unit linked life insurance, personal wealth plans as well as other investments options. Despite the availability of these various options, there is no one perfect solution that will exactly address your retirement needs. Therefore, it is important to understand how they can fit into your retirement planning and with proper advice and guidance, you are on your way to have your retirement secured before it comes.

Disclaimer: The information is brought to you by Aon Insurance & Reinsurance Brokers Philippines Inc., registration number 96590. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy. Current life expectancy is 83 years for men and 88 for women, which will translate to 18 and 23 years respectively in retirement, assuming retirement age is 65-years-old. What happens if you live beyond that?

Spending on health will also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health will increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Rome was not built in a day, just like retirement planning. Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, the best time is to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

Imagine this, Mr. Li saves CNY200 per month for 10 years at a high interest savings account of 5%, he will end up with CNY30,186.94 with CNY24,000 being his capital. And now we have Mr. Wang who starts saving 5 years later, but saves double the amount that Adam does, CNY400 per month for 5 years with the same interest, he will end up with CNY26,523.03, with CNY24,000 being his capital. Although both have put in the same amount, at the end of the day, with effects of compounding interest, the difference becomes amplified.

There are several options available that can assist you in reaching your retirement goals such as, annuity insurance plan as well as investments options and there is no one perfect solution that is able to suit your retirement needs. Therefore, it is important to understand how they can fit into your retirement planning and with proper advice and guidance, you are on your way to have your retirement secured before it comes.

Disclaimer: The information is brought to you by Aon Hewitt Consulting (Shanghai) Co. Ltd. registration number 310000400102466. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

享受一次轻松的海外旅行,而不必急着回去上班;发掘一些从未有机会尝试的新爱好;与孙辈相伴,一边享受一杯美味的咖啡,一边看着他们玩耍,这是您幻想中的退休生活吗?

退休是我们每个人的最终人生目标。从拿到第一张工资单到结婚、再到拥有自己的房子和组建自己的家庭,最终我们会面临退休。而谈到退休,我们很可能会想到上述场景。当然,每个人想要的退休生活都是不同的。

为了搞清楚退休后需要多少钱,您得先明确自己理想的退休生活方式。您可以看看您目前的每月开支,想象一下当您退休后会是怎样。还是很难想象?专家已经指出,一个人在退休后每月需要的生活费通常是您当前收入的60%到80%。此外,预期退休年龄以及预期寿命也会对您的退休资金情况产生影响。退休越早,或者预期寿命越长,您就必须留出越多的养老钱。目前男性的预期寿命为83岁,女性为88岁,假设退休年龄为65岁,那么男女从退休到去世的时间将分别为18年和23年。但如果您活得更久呢?

人老了之后,由于身体日渐衰弱,抵抗力或认知功能下降,容易突发疾病,健康方面的开支将增加。这也是您继续支付医疗保险费的原因,而您退休之后要缴纳的保费也会显著增加。

罗马不是一天建成的,退休计划也一样。您今天迈出的每一小步,都会为您的退休生活提供资金支持。开始为养老存钱没有什么最佳时间,越早越好。众所周知,您开始存钱的时间越晚,您需要存的钱就越多,如此才能达到您想要的总数,然而在复利的影响下,这种差异会相当显著。

想象一下,李先生每月将200元存入利率为5%的高息储蓄账户,存10年,最后他将得到30186.94元人民币,其中24000元是他的本金。然后再看看王先生,他5年后才开始存钱,但他每个月存的钱是李先生的两倍,即5年内每月存400元,利率不变,最后他的总存款是26523.03元,本金是24000元。尽管两人都投入了相同的本金,但最后,由于复利的影响,本息差额是很大的。

还有一些方法可以帮助您实现存够养老金的目标,比如年金保险计划以及投资,但没有哪种解决方案可以完美适合您的退休需求。因此,重要的是要了解如何在您的退休计划中利用这些方案,并获取适当的建议和指导,如此,您离安心退休就不远了。

免责声明:以上信息由怡安翰威特咨询(上海)有限公司(注册号310000400102466)提供。由于未考虑可能接收该信息的任何特定人士的具体投资目标、财务状况或特殊需求,因此,上述信息不能代替针对个别情况的具体建议。在您决定购买某投资产品之前,请考虑您的具体投资目标、财务状况或特殊需求,并向理财顾问咨询相关投资产品的适用性。此外,建议您在必要时获取其他专业建议。以上信息出于善意提供,在汇编时确认准确。我司无义务在今后更新相关信息或更正发现的不准确信息。用户应不时查阅各种信息来源,以获取准确的最新一手信息。

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy.

Spending on health may also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health may increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, but it good to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy.

Spending on health may also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health may increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, but it would be good to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

Author is not a financial advisor, tax professional or legal advisor. The article and its content is for informational purposes only, reader should not construe any such information or other material as legal, tax, investment, financial, or other advice. All information, data, strategies, reports, articles and all other features of this article are provided for informational and educational purposes only and should not be considered or inferred as personalized investment advice. Article may contain errors, and the reader should not make any financial or investment decision based solely on what the reader reads in this article and writing. It shall be reader’s responsibility to perform its own due diligence, and reader must make its own decisions. Be advised and aware that financial and investment decisions involve risk. Author accept no liability whatsoever for any direct or consequential loss arising from any use of author’s writings, products, services, website, or other content, including contents of this article. Reader is responsible for its own investment research and decisions. Reader should seek the advice of a qualified investment advisor and fully understand any and all risks before investing or making any financial decision. Author make no representation that any reader will or is likely to experience results as cited in this article. All results of author’s recommendations are not based on actual investments by author and are based upon a hypothesis, available statistics and surveys which have limitations and do not reflect all components of actual investments. Reader’s actual results may vary based upon many factors. All content and references to third-party sources is provided solely for convenience. This information may be inaccurate, use at your own risk.

By reading this article or any of its contents you agree that neither author nor its employees, shareholders, directors, contractors, affiliates, agents, third party content providers or licensors will be liable for any direct, indirect, incidental or any other type of claim, liability, cost, damage or loss resulting from reader’s use of any of this content. This includes, but is not limited to, loss or injury caused in whole or in part by contingencies beyond our control.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy.

Spending on health may also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health may increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, but it would be good to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

The content of this article does not constitute individual financial advice.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy.

Spending on health may also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health may increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, but it would be good to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

The information in this report does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations.

While we have made every attempt to ensure that the information contained in this report has been obtained from reliable sources, Aon is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this report is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Aon be liable to you or anyone else for any decision made or action taken in reliance on the information in this report or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy.

Spending on health may also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health may increase and more the reason for you to keep your medical insurance policies, which the premium would have increased significantly over the years.

Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, but it would be good to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

Det kan være en stund til pensjonsalderen, eller den kan være like rundt hjørnet. Men dette er et godt tidspunkt for å forberede seg på framtiden og tenke over hva du kan møte som pensjonist.

Sørge for at du har økonomisk frihet til å nyte livet

Hvordan ser du for deg pensjonisttilværelsen? Skal du ta lange utenlandsreiser uten å skynde deg hjem igjen, eller skaffe deg nye hobbyer du aldri har hatt tid til før, eller tilbringe tid med barnebarna på lekeplassen?

Livet som pensjonist er det endelige livsmålet for de fleste av oss. Det kommer en livsfase der vi ser tilbake på den gang vi fikk første lønnsutbetaling, giftet oss, kjøpte hus og stiftet familie. Det skjer gjerne når pensjonisttilværelsen nærmer seg, og naturligvis har vi alle ulike behov som pensjonister.

Det er viktig at du tenker over hvordan du skal leve som pensjonist for å få et begrep om hvor mye penger du trenger til pensjonistlivet. Se på ditt nåværende månedsbudsjett og tenk over hvordan budsjettet vil se ut som pensjonist. Eksperter anslår at de fleste typisk trenger mellom 60 % og 80 % av sine inntekter som yrkesaktive når de blir pensjonister. Forventet pensjonsalder og forventet levealder har også innvirkning på egen pensjonssparing. Jo tidligere du ønsker å pensjonere deg, desto større midler bør du sette av til egen pensjonssparing. Det samme gjelder også med tanke på forventet levealder.

For hvert lille steg du tar i dag, har du bedre muligheter til å sette av midler i egen pensjonssparing. Det er vanskelig å si hva som er beste tidspunkt for å starte egen pensjonssparing, men det kan være gunstig å starte så tidlig som mulig. Det er velkjent at jo senere du starter egen pensjonssparing, desto mer må du spare senere for å nå beløpet du ønsker deg. På grunn av effekten av rentes rente kan forskjellene bli store.

Que la retraite vous semble encore loin, ou toute proche, c’est le bon moment pour adopter quelques mesures simples afin de vous préparer pleinement à l’avenir et de savoir ce que vous pouvez attendre de la retraite.

S’assurer d’avoir la liberté financière pour profiter de la vie

Pouvoir se détendre lors d’un voyage à l’étranger sans devoir se précipiter pour retourner au travail, se livrer à de nouveaux passe-temps que vous n’avez jamais eu la chance de pratiquer, ou encore passer du temps avec vos petits-enfants tout en savourant une bonne tasse de café en les regardant jouer, est-ce là votre idée de la retraite ?

La retraite représente le but ultime de la vie pour chacun et chacune d’entre nous. Depuis le moment où nous encaissons notre premier chèque de paie jusqu’à celui où nous nous marions, achetons une maison et fondons notre propre famille, nous finirons tous par atteindre un stade où nous penserons aux activités à envisager durant notre retraite et, bien sûr, les besoins de chacun en matière de retraite seront différents.

Pour appréhender le montant dont vous aurez besoin pour votre retraite, il est important de connaître votre mode de vie idéal. Vous pouvez examiner votre budget mensuel actuel et imaginer à quoi il ressemblera lorsque vous serez à la retraite. Si vous trouvez trop compliqué d’envisager votre mode de vie durant votre retraite, des experts ont indiqué qu’il faut généralement 60 à 80 % de votre revenu actuel au moment de la retraite. De plus, l’âge de départ à la retraite prévu ainsi que l’espérance de vie auront également un impact sur le financement de votre retraite. Au plus tôt vous envisagez votre départ à la retraite, au plus vous devrez mettre de côté. Le même rapport s’applique à l’espérance de vie.

Les dépenses de santé peuvent également augmenter, à cause d’une plus grande fragilité, d’un événement médical soudain ou d’un déclin cognitif. Quelle qu’en soit la raison, les dépenses de santé peuvent augmenter et c’est pour cela qu’il est d’autant plus important de conserver les polices d’assurance maladie qui vous couvrent.

Chaque petit pas que vous faites aujourd’hui contribue au financement de votre retraite et vous permettra de vivre comme vous le souhaitez durant votre retraite. Il n’existe pas de moment idéal pour commencer à épargner pour votre retraite, mais il est judicieux de commencer le plus tôt possible. On sait que plus on commence à épargner tard, plus on doit épargner pour atteindre le montant de retraite souhaité, mais avec les effets des intérêts composés, la différence peut s’avérer très significative.

Je pensioen is misschien nog een eind weg, of net om de hoek, maar dit is een goed moment om een paar eenvoudige stappen te zetten om je volledig voor te bereiden op de toekomst en te weten waar je naar uit kunt kijken als je met pensioen gaat.

Zorgen voor financiële vrijheid om van het leven te genieten

Een ontspannende verre reis maken zonder je terug te hoeven haasten naar je werk, of nieuwe hobby's nastreven waar je nooit de kans toe hebt gehad, of tijd doorbrengen met je kleinkinderen terwijl je geniet van een kopje lekkere koffie en ze te zien spelen? Is dat hoe je je pensioen voorstelt?

Pensioen is het ultieme levensdoel voor ieder van ons. Vanaf het moment dat we ons eerste maandloon verdienen om te trouwen, een huis te kopen en ons eigen gezin te stichten, zijn we op weg om uiteindelijk een stadium te bereiken waarop we denken aan de genoemde pensioenactiviteiten. Uiteraard zien ieders pensioenwensen er anders uit.

Om te begrijpen hoeveel je nodig hebt voor je pensioen, is het belangrijk om je ideale pensioenlevensstijl te achterhalen. Je kan je huidige maandbudget bekijken en je voorstellen hoe het eruit zal zien wanneer je met pensioen gaat. Als het te moeilijk is om je je pensioenlevensstijl voor te stellen, hebben experts gezegd dat je tijdens je pensioen doorgaans 60% tot 80% van je huidige inkomen nodig hebt. Daarnaast zullen zowel de verwachte pensioenleeftijd en de levensverwachting ook een impact hebben op je pensioenfinanciering. Hoe eerder je met pensioen gaat, hoe meer je opzij moet zetten, ook voor je levensverwachting.

De uitgaven voor gezondheid kunnen ook toenemen, wat het gevolg kan zijn van hogere kwetsbaarheid, een plotselinge medische noodzakelijkheid of een afname van je cognitief vermogen. Wat de reden ook is, je gezondheidsuitgaven kunnen toenemen en des te meer reden zijn om je ziektekostenverzekeringen aan te houden, want de premie zou in de loop van de jaren aanzienlijk kunnen stijgen.

Elke kleine stap die je vandaag zet, draagt bij aan je pensioenfinanciering die je levensstijl tijdens je pensioen zal ondersteunen. Er is geen ideaal moment om te beginnen met sparen voor je pensioen, maar het is goed om zo vroeg mogelijk te beginnen. Het is bekend dat hoe later je begint met sparen, hoe meer geld je moet sparen om je gewenste pensioenbedrag te bereiken, maar met effecten van samengestelde rente wordt het verschil behoorlijk groot.

Sørg for, at du har økonomisk frihed til at nyde livet

At have mulighed for at tage på afslappende udlandsrejser uden at skulle skynde dig tilbage til arbejde, at prøve kræfter med nye hobbyer, som du aldrig har haft chancen for før, eller at tilbringe tiden med dine børnebørn, mens du nyder en god kop kaffe og ser dem lege – er det sådan, du forestiller dig din pensionstid?

Pensionering er det ultimative livsmål for os alle. Fra det øjeblik, vi begynder at tjene vores egne penge, til vi bliver gift, har hus og starter vores egen familie, er det kun et spørgsmål om tid, før vi begynder at tænke på de ovenstående aktiviteter i forhold til pensionering – og selvfølgelig vil alles pensionsdrømme være forskellige.

For at forstå, hvor meget du har brug for til din pensionering, er det vigtigt at finde ud af, hvordan dit ideelle otium ser ud. Du kan se på dit nuværende månedlige budget og forestille dig, hvordan det vil se ud, når du bliver pensioneret. Hvis det er for svært at forestille sig pensionslivet, siger eksperter, at man typisk har brug for 60-80 % af sin nuværende indkomst, når man er pensioneret. Derudover vil den forventede pensionsalder såvel som forventet levetid også påvirke din pensionsfond. Jo tidligere du begynder at kigge på pension, jo mere vil du have at sætte til side, og det samme gælder for din forventede levetid.

Helbredsudgifter kan også stige, hvilket kan skyldes øget svagelighed, en pludselig helbredsmæssig hændelse eller svækkelse af kognitive funktioner. Uanset årsagen kan dine helbredsudgifter stige, hvilket blot er endnu mere grund til at have styr på dine sygesikringspolicer, hvis præmien kan være steget betydeligt gennem årene.

Hvert lille skridt du tager i dag, bidrager til din pensionsfond, der skal understøtte din livsstil, når du er gået på pension. Der er intet tidspunkt, der er "bedst" at påbegynde en pensionsopsparing på, men det er godt at starte så tidligt som muligt. Det er velkendt, at jo senere du starter med at spare op, jo flere penge skal du spare for at nå dit ønskede pensionsbeløb, men med effekten af rentes rente bliver forskellen væsentlig.

Η συνταξιοδότηση μπορεί να φαίνεται μακρινή ακόμα ή να βρίσκεται προ των πυλών, αλλά τώρα είναι μια καλή ευκαιρία να πραγματοποιήσετε μερικές απλές ενέργειες που θα σας προετοιμάσουν πλήρως για το μέλλον και, επίσης, θα γνωρίζετε τι να αναμένετε κατά τη συνταξιοδότηση.

Φροντίστε να έχετε την απαραίτητη οικονομική ελευθερία για να απολαύσετε τη ζωή

Μήπως το όραμά σας για τη συνταξιοδότηση είναι να έχετε τη δυνατότητα να κάνετε χαλαρωτικά ταξίδια στο εξωτερικό χωρίς να πρέπει να γυρίσετε βιαστικά στην εργασία ή να ξεκινήσετε νέα χόμπι με τα οποία ποτέ δεν είχατε την ευκαιρία να ασχοληθείτε ή να αφιερώνετε χρόνο στα εγγόνια σας και να τα παρακολουθείτε να παίζουν ενώ απολαμβάνετε τον καφέ σας;

Η συνταξιοδότηση είναι ο υπέρτατος στόχος ζωής για τον καθένα μας. Από τη στιγμή που λαμβάνουμε τον πρώτο μας μισθό μέχρι στη στιγμή που παντρευόμαστε, αγοράζουμε σπίτι και ξεκινάμε την οικογένειά μας, φτάνουμε σε ένα σημείο που αναλογιζόμαστε τις εν λόγω δραστηριότητες σε σχέση με τη συνταξιοδότηση και, φυσικά, ο καθένας μας έχει διαφορετικές ανάγκες συνταξιοδότησης.

Για να εκτιμήσετε πόσα χρήματα χρειάζεστε για τη συνταξιοδότησή σας, είναι σημαντικό να προσδιορίσετε τον ιδανικό τρόπο ζωής που θα ακολουθήσετε κατά τη συνταξιοδότησή σας. Μπορείτε να μελετήσετε τον τρέχοντα μηνιαίο προϋπολογισμό σας και να φανταστείτε τη μορφή που θα έχει όταν συνταξιοδοτηθείτε. Εάν είναι πολύ δύσκολο να οραματιστείτε τον τρόπο ζωής που θα ακολουθήσετε κατά τη συνταξιοδότησή σας, οι ειδικοί αναφέρουν ότι ένα άτομο χρειάζεται συνήθως το 60-80% του τρέχοντος εισοδήματός του όταν συνταξιοδοτηθεί. Επιπλέον, η αναμενόμενη ηλικία συνταξιοδότησης, όπως και το προσδόκιμο ζωής, θα επηρεάσουν επίσης τη χρηματοδότηση της συνταξιοδότησής σας. Όσο πιο νωρίς υπολογίζετε να συνταξιοδοτηθείτε, τόσα περισσότερα χρήματα πρέπει να αποταμιεύετε, το ίδιο ισχύει και με το προσδόκιμο ζωής.

Οι δαπάνες για την υγεία ενδέχεται να αυξηθούν, επίσης, λόγω αυξημένης ευπάθειας, απροσδόκητου ιατρικού συμβάντος ή εξασθένιση της γνωστικής λειτουργίας. Ανεξάρτητα από την αιτία, οι δαπάνες για την υγεία μπορεί να αυξηθούν και αυτό είναι ένας ακόμα επιτακτικός λόγος για να διατηρήσετε τα ασφαλιστήρια συμβόλαια που προσφέρουν ιατρική κάλυψη.

Και η πιο ασήμαντη ενέργεια που πραγματοποιείτε σήμερα συμβάλλει στη χρηματοδότηση της συνταξιοδότησής σας, που θα υποστηρίξει τον τρόπο ζωής που θα ακολουθήσετε όταν συνταξιοδοτηθείτε. Δεν υπάρχει η καλύτερη στιγμή για να ξεκινήσετε την αποταμίευση για τη συνταξιοδότησή σας, αλλά καλό είναι να ξεκινήσετε όσο το δυνατόν πιο νωρίς. Είναι γνωστό ότι όσο πιο αργά ξεκινήσετε την αποταμίευση, τόσο πιο πολλά χρήματα θα πρέπει να αποταμιεύετε για να φτάσετε στο επιθυμητό ποσό συνταξιοδότησης. Εντούτοις, χάρη στον ανατοκισμό, η διαφορά μπορεί να είναι σημαντική.

Tanto si la jubilación le queda aún lejos como si está a la vuelta de la esquina, siempre es buen momento para dar una serie de sencillos que le permitan prepararse adecuadamente para el futuro y saber qué puede esperar de su vida tras retirarse.

Asegúrese de disponer de libertad financiera para disfrutar de la vida

Poder relajarse en un viaje al extranjero sin tener que volver a toda prisa para trabajar, descubrir nuevas aficiones que nunca tuvo la oportunidad de probar o ver jugar a sus nietos mientras disfruta de un buen café son, en todos los casos, visiones soñadas de cualquier jubilación.

Para todos y cada uno de nosotros, la jubilación es el objetivo último en la vida. Desde que recibimos nuestro primer sueldo, nos casamos y compramos una casa hasta que formamos una familia, a todos nos llega ese momento en el que comenzamos a pensar en qué nos gustaría hacer durante nuestra jubilación, y por supuesto las necesidades de cada persona durante esta etapa serán distintas.

Para saber la cantidad de dinero que necesitará para su jubilación, es importante que identifique cuál sería su estilo de vida ideal durante esta. Puede empezar por echar un vistazo a su presupuesto mensual actual e imaginarse si sería suficiente durante su jubilación. Por otra parte, su edad de jubilación prevista y su esperanza de vida también tendrán un impacto sobre los fondos que podría necesitar para afrontar este periodo de su vida. Cuanto antes tenga previsto jubilarse y mayor sea su esperanza de vida, más dinero deberá reservar.

Su gasto en atención sanitaria también podría incrementarse, ya sea como consecuencia del deterioro de su salud por el paso de los años, un problema médico repentino o un descenso en sus capacidades cognitivas. Sea cual sea la razón, puede que tenga que gastar más en su salud, y esta es una razón de peso más para mantener aquellas de sus pólizas de seguro médico.

Cada pequeño paso que dé hoy contribuirá a acrecentar los fondos que le permitirán mantener el estilo de vida que desea para su jubilación. Aunque no existe un momento perfecto para comenzar a ahorrar para su jubilación, es importante que comience a hacerlo lo antes posible. Está demostrado que cuanto más tarde se comienza a ahorrar, mayor es la cantidad de dinero que se necesita acumular para alcanzar el importe del que se desea disponer durante la jubilación. Además, con los efectos de la capitalización compuesta de intereses, la diferencia entre empezar antes o hacerlo después es bastante notable.

Akár még messze, akár már közel van a nyugdíj, ez egy jó időpont arra, hogy megtegyél néhány egyszerű lépést, hogy teljesen felkészülj a jövőre, és tudd, hogy mit várhatsz a nyugdíjas éveidben.

Biztosítsd az élet élvezetéhez szükséges pénzügyi szabadságot

El tudsz menni egy pihentető tengerentúli utazásra anélkül, hogy sietni kellene vissza a munkahelyre, vagy új hobbikat próbálsz ki, amelyekre sosem volt lehetőséged, vagy időt töltesz az unokáiddal, miközben egy bögre kellemes kávét kortyolsz, és nézed őket, ahogy játszanak; így képzeled el a nyugdíjas éveid?

A nyugdíj a végső életcél mindannyiunk számára. Attól a pillanattól kezdve, hogy megkapjuk az első fizetési csekkünket, összeházasodunk, lesz egy házunk, megalapítjuk a családunkat, végül elérünk egy szakaszt, amikor az említett tevékenységekre gondolunk, ha a nyugdíjról van szó, és természetesen mindenkinek különbözőek a nyugdíjjal kapcsolatos szükségletei.

Ahhoz, hogy megértsd, mennyi pénzre van szükséged a nyugdíjhoz, fontos meghatározni az ideális nyugdíjas életmódodat. Megnézheted a jelenlegi havi költségvetésed, és elképzelheted, milyen lesz, amikor nyugdíjas leszel. Ha túl bonyolult elképzelned a nyugdíjas életmódod, a szakemberek szerint az embernek átlagosan a jelenlegi bevételének 60–80%-ára van szüksége a nyugdíj során. Továbbá a várható nyugdíjkorhatár, illetve a várható élettartam szintén befolyásolják a nyugdíjalapod. Minél előbb kezdesz foglalkozni a nyugdíjjal, annál többet tudsz félretenni, és ugyanez vonatkozik a várható élettartamra is.

Az egészségügyi kiadások is megnövekedhetnek, amelynek oka a betegségekre való fokozott hajlam, egy hirtelen egészségügyi esemény vagy a kognitív funkciók hanyatlása lehet. Bármi is az ok, az egészségügyi kiadások megnövekedhetnek, és ez még inkább ok arra, hogy megőrizd az egészségügyi biztosításod, amely fedezetet nyújt.

Minden kis lépés, amelyet ma megteszel, hozzájárul a nyugdíjalapodhoz, amely a nyugdíjas életmódodat támogatja. Nincs ideális jobb időpont arra, hogy elkezdj félretenni a nyugdíjas évekre, de jobb minél előbb elkezdeni. Ismert tény, hogy minél később kezded el a megtakarítást, annál több pénzt kell félretenned, hogy elérd a kívánt nyugdíjas összeget; azonban a kamatos kamat hatásaival a különbség eléggé jelentős lesz.

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.

To understand how much you need for your retirement, it is important to find out your ideal retirement lifestyle. You can look at your current monthly budget and imagine how it will look like when you are in retirement. If it is too difficult to vision your retirement lifestyle, experts have mentioned that one typically need 60% to 80% of your current income during retirement. In addition, expected retirement age as well as life expectancy will also have an impact on your retirement funding. The earlier you are looking at retiring, the more you will have to set aside, likewise for life expectancy.

Spending on health may also increase, which may be due to increased frailty, a sudden medical event or decline in cognitive functioning. Whatever the reason, spending on health may increase and this is more the reason for you to retain any medical insurance policies, which provide cover.

Each small step that you take today, contributes to your retirement funding that will support your retirement lifestyle. There is no best time to start saving for your retirement, but it good to start as early as possible. It is a known fact that the later you start saving, the more money you will have to save to reach your desired retirement amount, however with effects of compounding interest, the difference becomes quite significant.

The content of this article does not constitute individual financial advice.

La retraite peut vous sembler lointaine, ou très proche, mais il est toujours bon de prendre quelques mesures simples pour se préparer à l’avenir en sachant à quoi vous attendre au moment de la retraite.

Garantissez votre indépendance financière pour profiter de la vie

Pouvoir partir en vacances à l’étranger pour vous détendre sans devoir retourner au travail, vous adonner à de nouveaux passe-temps que vous n’avez jamais eu la chance de faire ou passer du temps avec vos petits-enfants à les regarder jouer en buvant un café ... Est-ce ainsi que vous envisagez votre retraite ?

La retraite est l’objectif ultime pour chacun d’entre nous. Du moment où nous recevons notre premier bulletin de salaire au moment où nous nous marions, achetons une maison et fondons notre propre famille, nous finissons tous par arriver au stade où nous pensons aux activités que nous allons faire à la retraite. Bien entendu, les besoins de chacun pour la retraire sont différents.

Afin de comprendre vos futurs besoins à la retraite, il est important de déterminer le mode de vie idéal que vous envisagez pour votre retraite. Étudiez votre budget mensuel actuel et imaginez à quoi il ressemblera lorsque vous serez à la retraite. S’il est trop difficile d’envisager votre mode de vie à la retraite, les spécialistes estiment qu’entre 60 et 80 % des revenus actuels sont nécessaires pour la retraite. L’âge de la retraite prévu et l’espérance de vie auront également un impact sur le financement de votre retraite. Si vous envisagez de prendre une retraite anticipée, vous devrez épargner davantage. Il en va de même pour l’espérance de vie.

Les dépenses de santé pourront également augmenter, en raison d’une plus grande fragilité, d’un problème médical soudain ou d’un déclin cognitif. Quelle qu’en soit la raison, les dépenses de santé pourront augmenter, d’où l’importance de conserver votre mutuelle d'assurance maladie pour continuer à bénéficier d'une couverture.

Chaque mesure que vous prenez aujourd’hui, aussi infime soit-elle, contribue au financement de votre mode de vie une fois en retraite. Il n’y a pas de moment idéal pour commencer à économiser pour votre retraite, mais plus tôt vous le faites, mieux c'est. On sait bien que plus on attend pour épargner, plus il faudra économiser d’argent pour atteindre la somme que vous vous êtes fixée pour la retraite, mais avec les effets des intérêts composés, la différence devient relativement importante.

Der Ruhestand mag noch in weiter Ferne liegen oder direkt vor der Tür stehen – in jedem Fall ist dies ein guter Zeitpunkt, um ein paar einfache Maßnahmen zu ergreifen, um bestmöglich auf die Zukunft vorbereitet zu sein und zu wissen, worauf Sie sich in Ihrem Ruhestand freuen können.

Sicherstellen, dass Sie die finanzielle Unabhängigkeit besitzen, um das Leben zu genießen

Eine entspannende Auslandsreise ohne die Pflicht, an Ihren Arbeitsplatz zurückzukehren, ein neues Hobby, für das es bisher nie die passende Gelegenheit gab, Zeit mit Ihren Enkeln verbringen oder ihnen bei einer Tasse Kaffee beim Spielen zuzusehen ... Stellen Sie sich Ihren Ruhestand so vor?

Der Ruhestand ist für uns alle das oberste Lebensziel. Ab dem Moment, in dem wir unseren ersten Gehaltsscheck in Händen halten, heiraten, ein Haus bauen und eine Familie gründen, steuern wir unweigerlich auf den Lebensabschnitt zu, in dem wir uns unseren Ruhestand und die oben genannten Aktivitäten ausmalen. Jeder hat dabei andere Bedürfnisse.

Um einschätzen zu können, welche Rücklagen Sie für Ihren Ruhestand brauchen, müssen Sie herausfinden, welchen Lebensstil Sie in diesem Lebensabschnitt pflegen möchten. Sehen Sie sich Ihr aktuelles monatliches Budget an und überlegen Sie, wie es in Ihrem Ruhestand aussehen wird. Wenn es Ihnen schwerfällt, sich Ihren Lebensstil im Ruhestand vorzustellen, können Sie sich auf die Aussagen von Experten stützen, denen zufolge Sie als Ruheständler durchschnittlich etwa 60 % bis 70 % Ihres aktuellen Einkommens benötigen werden. Der voraussichtliche Zeitpunkt Ihres Renteneintritts und die Lebenserwartung wirken sich darüber hinaus ebenfalls auf das notwendige finanzielle Polster für Ihren Ruhestand aus. Je früher Sie in den Ruhestand gehen wollen, desto mehr müssen Sie beiseite legen. Für die Lebenserwartung gilt dasselbe.

Außerdem können Ihre Gesundheitsausgaben aufgrund zunehmender Gebrechlichkeit, eines plötzlichen medizinischen Zwischenfalls oder kognitiver Beeinträchtigungen steigen. Was immer der Grund sein mag, Ihre Ausgaben für Ihre Gesundheit können steigen. Deshalb sollten Sie Ihre Krankenversicherungen unbedingt beibehalten, denn sie decken diese Kosten ab.

Jeder noch so kleine Schritt, den Sie heute unternehmen, trägt dazu bei, dass die finanziellen Mittel für Ihren Ruhestand ausreichen, um diesen Ihren Vorstellungen entsprechend zu genießen. Es gibt keinen idealen Zeitpunkt, um mit der Altersvorsorge zu beginnen, aber grundsätzlich gilt: je eher, desto besser. Es ist eine wohlbekannte Tatsache, dass der Sparbetrag, um ein bestimmtes finanzielles Polster für Ihren Ruhestand anzusparen, umso höher sein muss, je später Sie mit dem Sparen beginnen. Berücksichtigt man den Zinseszinseffekt, ergibt sich ein ganz erheblicher Unterschied.

La pensione potrebbe essere ancora lontana oppure proprio dietro l’angolo, ma è bene effettuare alcune semplici operazioni per prepararsi al futuro e sapere cosa aspettarti una volta in pensione.

Assicurati di avere la libertà economica per goderti la vita

Poter fare un viaggio rilassante oltreoceano senza dover rientrare in fretta e furia per andare al lavoro, oppure dedicarsi a nuovi passatempi di cui non hai mai avuto l’occasione di occuparti, trascorrere del tempo con i nipoti mentre ci si gode una bella tazza di caffè e li si guarda giocare: è questa la tua idea di pensione?

La pensione è l’ultimo obiettivo della vita di ognuno. Il momento in cui incassiamo il primo stipendio e lo mettiamo da parte per sposarci, per comprare casa e mettere su famiglia: prima o poi raggiungiamo una fase, cioè quando andiamo in pensione, in cui ripensiamo ai suddetti momenti. Ovviamente il periodo della pensione non può essere uguale per tutti.

Per capire di quanto hai bisogno per la pensione, è importante scoprire qual è il tuo stile di vita ideale. Puoi considerare il tuo attuale budget mensile e immaginare a quanto ammonterà quando sarai in pensione. Se è troppo difficile immaginare quale sarà il tuo tenore di vita in pensione, gli esperti sostengono che in genere in pensione è necessario il 60% - 80% dell’attuale reddito. Inoltre, sia l’età pensionabile prevista che l’aspettativa di vita avranno ripercussioni sul tuo fondo pensionistico. Se si prevede di andare in pensione anticipatamente, allora si dovranno mettere da parte più risparmi, e lo stesso vale per l'aspettativa di vita.

Inoltre le spese sanitarie potrebbero aumentare a causa di una maggiore cagionevolezza, un'urgenza medica improvvisa o un declino delle funzioni cognitive. Qualunque sia il motivo, le spese sanitarie potrebbero aumentare, quindi è una ragione in più per stipulare delle polizze mediche, in grado di fornire una copertura.

Ogni piccola operazione conclusa oggi, contribuisce al fondo pensionistico a sostegno del tuo stile di vita in pensione. Non si può stabilire a priori quale sia il momento migliore per iniziare a risparmiare per la pensione, ma prima si comincia meglio è. È un dato di fatto che più tardi inizi a risparmiare, più soldi dovrai mettere da parte per raggiungere l’importo desiderato per la pensione, ma con gli effetti dell’interesse composto, la differenza diventa piuttosto significativa.

La retraite peut vous sembler lointaine, ou très proche, mais il est toujours bon de prendre quelques mesures simples pour se préparer à l’avenir en sachant à quoi vous attendre au moment de la retraite.

Garantissez votre indépendance financière pour profiter de la vie

Pouvoir partir en vacances à l’étranger pour vous détendre sans devoir retourner au travail, vous adonner à de nouveaux passe-temps que vous n’avez jamais eu la chance de faire ou passer du temps avec vos petits-enfants à les regarder jouer en buvant un café ... Est-ce ainsi que vous envisagez votre retraite ?

La retraite est l’objectif ultime pour chacun d’entre nous. Du moment où nous recevons notre premier bulletin de salaire au moment où nous nous marions, achetons une maison et fondons notre propre famille, nous finissons tous par arriver au stade où nous pensons aux activités que nous allons faire à la retraite. Bien entendu, les besoins de chacun pour la retraire sont différents.

Afin de comprendre vos futurs besoins à la retraite, il est important de déterminer le mode de vie idéal que vous envisagez pour votre retraite. Étudiez votre budget mensuel actuel et imaginez à quoi il ressemblera lorsque vous serez à la retraite. S’il est trop difficile d’envisager votre mode de vie à la retraite, les spécialistes estiment qu’entre 60 et 80 % des revenus actuels sont nécessaires pour la retraite. L’âge de la retraite prévu et l’espérance de vie auront également un impact sur le financement de votre retraite. Si vous envisagez de prendre une retraite anticipée, vous devrez épargner davantage. Il en va de même pour l’espérance de vie.

Les dépenses de santé pourront également augmenter, en raison d’une plus grande fragilité, d’un problème médical soudain ou d’un déclin cognitif. Quelle qu’en soit la raison, les dépenses de santé pourront augmenter, d’où l’importance de conserver votre mutuelle d'assurance maladie pour continuer à bénéficier d'une couverture.

Chaque mesure que vous prenez aujourd’hui, aussi infime soit-elle, contribue au financement de votre mode de vie une fois en retraite. Il n’y a pas de moment idéal pour commencer à économiser pour votre retraite, il vaut mieux commencer le plus tôt possible. On sait bien que plus on attend pour épargner, plus il faudra économiser d’argent pour atteindre la somme que vous vous êtes fixée pour la retraite, mais avec les effets des intérêts composés, la différence devient relativement importante.

La pensione potrebbe essere ancora lontana oppure proprio dietro l’angolo, ma è bene effettuare alcune semplici operazioni per prepararsi al futuro e sapere cosa aspettarti una volta in pensione.

Assicurati di avere la libertà economica per goderti la vita

Poter fare un viaggio rilassante oltreoceano senza dover rientrare in fretta e furia per andare al lavoro, oppure dedicarsi a nuovi passatempi di cui non hai mai avuto l’occasione di occuparti, trascorrere del tempo con i nipoti mentre ci si gode una bella tazza di caffè e li si guarda giocare: è questa la tua idea di pensione?

La pensione è l’ultimo obiettivo della vita di ognuno. Il momento in cui incassiamo il primo stipendio e lo mettiamo da parte per sposarci, per comprare casa e mettere su famiglia: prima o poi raggiungiamo una fase, cioè quando andiamo in pensione, in cui ripensiamo ai suddetti momenti. Ovviamente il periodo della pensione non può essere uguale per tutti.

Per capire di quanto hai bisogno per la pensione, è importante scoprire qual è il tuo stile di vita ideale. Puoi considerare il tuo attuale budget mensile e immaginare a quanto ammonterà quando sarai in pensione. Se è troppo difficile immaginare quale sarà il tuo tenore di vita in pensione, gli esperti sostengono che in genere in pensione è necessario il 60% - 80% dell’attuale reddito. Inoltre, sia l’età pensionabile prevista che l’aspettativa di vita avranno ripercussioni sul tuo fondo pensionistico. Se si prevede di andare in pensione anticipatamente, allora si dovranno mettere da parte più risparmi, e lo stesso vale per l'aspettativa di vita.

Inoltre le spese sanitarie potrebbero aumentare a causa di una maggiore cagionevolezza, un'urgenza medica improvvisa o un declino delle funzioni cognitive. Qualunque sia il motivo, le spese sanitarie potrebbero aumentare, quindi è una ragione in più per stipulare delle polizze mediche, in grado di fornire una copertura.

Ogni piccola operazione conclusa oggi, contribuisce al fondo pensionistico a sostegno del tuo stile di vita in pensione. Non si può stabilire a priori quale sia il momento migliore per iniziare a risparmiare per la pensione, ma prima si comincia meglio è. È un dato di fatto che più tardi inizi a risparmiare, più soldi dovrai mettere da parte per raggiungere l’importo desiderato per la pensione, ma con gli effetti dell’interesse composto, la differenza diventa piuttosto significativa.

Der Ruhestand mag noch in weiter Ferne liegen oder direkt vor der Tür stehen – in jedem Fall ist dies ein guter Zeitpunkt, um ein paar einfache Maßnahmen zu ergreifen, um bestmöglich auf die Zukunft vorbereitet zu sein und zu wissen, worauf Sie sich in Ihrem Ruhestand freuen können.

Sicherstellen, dass Sie die finanzielle Unabhängigkeit besitzen, um das Leben zu genießen

Eine entspannende Auslandsreise ohne die Pflicht, an Ihren Arbeitsplatz zurückzukehren, ein neues Hobby, für das es bisher nie die passende Gelegenheit gab, Zeit mit Ihren Enkeln verbringen oder ihnen bei einer Tasse Kaffee beim Spielen zuzusehen ... Stellen Sie sich Ihren Ruhestand so vor?

Der Ruhestand ist für uns alle das oberste Lebensziel. Ab dem Moment, in dem wir unseren ersten Gehaltsscheck in Händen halten, heiraten, ein Haus bauen und eine Familie gründen, steuern wir unweigerlich auf den Lebensabschnitt zu, in dem wir uns unseren Ruhestand und die oben genannten Aktivitäten ausmalen. Jeder hat dabei andere Bedürfnisse.

Um einschätzen zu können, welche Rücklagen Sie für Ihren Ruhestand brauchen, müssen Sie herausfinden, welchen Lebensstil Sie in diesem Lebensabschnitt pflegen möchten. Sehen Sie sich Ihr aktuelles monatliches Budget an und überlegen Sie, wie es in Ihrem Ruhestand aussehen wird. Wenn es Ihnen schwerfällt, sich Ihren Lebensstil im Ruhestand vorzustellen, können Sie sich auf die Aussagen von Experten stützen, denen zufolge Sie als Ruheständler durchschnittlich etwa 60 % bis 70 % Ihres aktuellen Einkommens benötigen werden. Der voraussichtliche Zeitpunkt Ihres Renteneintritts und die Lebenserwartung wirken sich darüber hinaus ebenfalls auf das notwendige finanzielle Polster für Ihren Ruhestand aus. Je früher Sie in den Ruhestand gehen wollen, desto mehr müssen Sie beiseite legen. Für die Lebenserwartung gilt dasselbe.

Außerdem können Ihre Gesundheitsausgaben aufgrund zunehmender Gebrechlichkeit, eines plötzlichen medizinischen Zwischenfalls oder kognitiver Beeinträchtigungen steigen. Was immer der Grund sein mag, Ihre Ausgaben für Ihre Gesundheit können steigen. Deshalb sollten Sie Ihre Krankenversicherungen unbedingt beibehalten, denn sie decken diese Kosten ab.

Jeder noch so kleine Schritt, den Sie heute unternehmen, trägt dazu bei, dass die finanziellen Mittel für Ihren Ruhestand ausreichen, um diesen Ihren Vorstellungen entsprechend zu genießen. Es gibt keinen idealen Zeitpunkt, um mit der Altersvorsorge zu beginnen, aber grundsätzlich gilt: je eher, desto besser. Es ist eine wohlbekannte Tatsache, dass der Sparbetrag, um ein bestimmtes finanzielles Polster für Ihren Ruhestand anzusparen, umso höher sein muss, je später Sie mit dem Sparen beginnen. Berücksichtigt man den Zinseszinseffekt, ergibt sich ein ganz erheblicher Unterschied.

Emekli olmak kimileri için uzun bir sürecin sonu iken kimileri için ise yolun hemen köşesinde bekliyor olabilir. Her iki durumda da geleceğe tam olarak hazırlanmak ve emeklilikte sizi neyin beklediğini bilmek için birkaç basit adım atmakta fayda olabilir.

Hayattan zevk almak için finansal olarak özgür olduğunuzdan emin olun. Emeklilik hayaliniz torunlarınızın oyun oynamasını seyretmek, yeni hobiler edinmek veya denizaşırı ülkelere seyahat etmek olabilir.

Emeklilik, yaşam döngüsündeki süreçlerden birisidir. İş hayatına atılıp, ilk maaşımızı kazanmaya başladığımız andan itibaren aşama aşama emekli olmaya yaklaşırız ve her birimizin emeklilik beklentisi farklıdır.Emeklilik döneminizde ne kadarlık bir gelire ihtiyacınız olacağını anlamak için ideal emeklilik yaşam tarzınızı bulmak önemlidir. Mevcut aylık bütçenize bakabilir ve emekli olduğunuzda nasıl görüneceğini hayal edebilirsiniz. Emeklilik yaşam tarzınız nasıl olursa olsun, uzmanlar emeklilik sırasında mevcut gelirinizin yaklaşık olarak % 60 - % 80'ine ihtiyaç duyduğunu belirtmektedirler. Ayrıca, tahmini emeklilik yaşınız ve yaşam beklentiniz de emeklilik fonunuz üzerinde etkili olacaktır. Tasarruf etmeye ne kadar erken başlarsanız, birikim süreciniz de o kadar rahat geçecektir.Emeklilik döneminde sağlık harcamalarınız artabilir. Sebebi ne olursa olsun, artan Sağlık harcamalarınız ile birlikte sigorta priminiz de yıllar içinde önemli ölçüde artacaktır.Bugün attığınız her küçük adım, emeklilik yaşam tarzınızı destekleyecek birikim fonunuza katkıda bulunur. Emekliliğe yönelik tasarruf etmeye başlamak için ideal zaman yoktur, ne kadar erken başlarsanız yararınıza olacaktır. Biriktirmeye geç başladığınızda, istediğiniz emeklilik miktarına ulaşmak için daha fazla tasarruf yapmanız gerekecektir.

退休生活對您來說可能要很久,或已經快接近了。但從現在開始,進行一些簡單的步驟為未來做好充分準備,了解您在退休生活中可以期待些什麼。

確保您有財務自由來享受生活

能夠輕鬆地出國旅行、不必匆忙地趕著上班、追求以前沒機會追求的嗜好、或花時間與孫子/孫女一起享受一杯美味的咖啡、看著他們玩耍,這就是您的退休願景嗎?

退休是我們每個人的終極人生目標,當我們開始賺取第一份薪水到結婚、開始擁有房子並建立家庭時,最終我們將達到退休階段且開始考慮前述的退休生活。當然地,每個人的退休需求都會不一樣。

了解您需要準備多少退休金,其中重要的是找出您理想的退休生活方式。您可以查看目前每月的預算,並想像一下退休時的樣子。如果很難想像您的退休生活,專家認為人們退休後,通常需要目前收入的60%至80%。此外,預計退休年齡及預期壽命也影響退休金目標。若希望退休的時間越早,就必須準備更多的錢,這也適用於預期壽命的長短。

退休後可能面臨身體衰退、突發醫療事件,或認知功能下降,因此在醫療保健方面的支出也會增加。無論出於何種原因,您持有醫療保單的原因會更多,且保費會隨著時間大幅增加。

您今天邁出的每一小步,都會為未來的退休金做出貢獻,並支持您的退休生活。沒有什麼最好的退休儲蓄時間點,反而是越早開始越好。當越晚開始儲蓄,就需要存更多的錢來達到退休金目標,此外,受複利的影響,越早存與越晚存會使的退休金的差距更大。

Retirement might still be a way off, or just around the corner, but this is a good time to take a few simple steps to get fully prepared for the future and know what you can look forward to in retirement.

Making sure you have financial freedom to enjoy life

Being able to have a relaxing overseas trip without having to rush back to work or pursuing new hobbies that you never had the chance to or spending time with your grandchildren while enjoying a cup of nice coffee and watching them play around, is that how you vision your retirement to be?

Retirement is the ultimate life goal for each one of us. The moment we start earning our first pay-check to getting married, having a house and setting up our own family, eventually we will reach a stage where we think of the mentioned activities when it comes to retirement and of course, everyone’s retirement needs will be different.