The Importance of Insurance

Select a country below to read the localised content of this article.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves! Have you ever heard of doctors falling sick, or Financial Advisors submitting a medical claim for themselves? Are they superhuman or do they have the immunity against sickness and unfortunate events? The answer is no, like anyone of us, chances of meeting with unfortunate events are the same, after all we are only human. And this is where having insurance is important.

For those in the 20s that have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over. Most common policies that are being passed over is the medical insurance policy; since premium is payable via CPF and even with rider, the premium is manageable due to young age. Essentially it helps take care of the medical cost in the event of hospitalisation. In addition, for Singaporeans and SPRs, the moment you receive your first CPF working contribution, and you will be automatically included under Dependant Protection Scheme (DPS)[1], a term insurance plan that provides coverage of $46,000 up to 60 years old in the event of death or Total Permanent Disability (TPD). Yearly premiums for DPS can be paid using your CPF savings or cash. At this stage, it will also be worthwhile to have your most important asset protected, and that is the ability to earn an income.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse do not have to worry about the remaining mortgage and your children’s education need becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for a long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to sit down with a financial advisor to assist you in understanding your current life situation, identifying your needs and to ensure that you are not under or over-insured.

DPS is offered to Singaporeans and SPRs on an opt-out basis, eligibility for coverage is still subject to the insured being in good health, and he/she must declare and fully disclose all health-related information. For more information, please refer to: https://www.cpf.gov.sg/Members/Schemes/schemes/other-matters/dependants-protection-scheme

Disclaimer: The information is brought to you by Aon Singapore Pte Ltd, registration number 198301525W. Aon Singapore Pte Ltd is a registered insurance broker and exempt financial adviser regulated by the Monetary Authority of Singapore. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves! Have you ever heard of doctors falling sick, or Financial Advisors submitting a medical claim for themselves? Are they superhuman or do they have the immunity against sickness and unfortunate events? The answer is no, like anyone of us, chances of meeting with unfortunate events are the same, after all we are only human. And this is where having insurance is important.

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to sit down with a financial advisor to assist you in understanding your current life situation, identifying your needs and to ensure that you are not under or over-insured.

Disclaimer: The information is brought to you by Aon Hong Kong Limited. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent later. You should always consult primary or more accurate or more up-to-date sources of information.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves! Have you ever heard of doctors falling sick, or Financial Advisors submitting a medical claim for themselves? Are they superhuman or do they have the immunity against sickness and unfortunate events? The answer is no. Like any one of us, the chances of meeting unfortunate events are the same, after all we are only human. And this is exactly why having insurance protection is important.

If you are in your 20s and had just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment. Examples of which might be related to car loans, mortgage loans as a result of buying a condo or townhouse, or other loans that need to be paid off. Ensuring that your surviving spouse do not have to worry about the remaining loans and your children’s educational needs becomes your priority. Any surplus that you can have at this stage should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are already grown-ups, the need for a long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health will increase with age.

Every one of us is different, hence there is a need to sit down with a financial advisor to assist you in understanding your current life situation, identifying your needs and to ensure that you are not under or over-insured.

Disclaimer: The information is brought to you by Aon Insurance & Reinsurance Brokers Philippines Inc., registration number 96590. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves! Have you ever heard of doctors falling sick, or Financial Advisors submitting a medical claim for themselves? Are they superhuman or do they have the immunity against sickness and unfortunate events? The answer is no, like anyone of us, chances of meeting with unfortunate events are the same, after all we are only human. And this is where having insurance is important.

For those in the 20s that have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse do not have to worry about the remaining mortgage and your children’s education need becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for a long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to sit down with a financial advisor to assist you in understanding your current life situation, identifying your needs and to ensure that you are not under or over-insured.

Disclaimer: The information is brought to you by Aon Hewitt Consulting (Shanghai) Co. Ltd. registration number 310000400102466. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

人们普遍相信“有些事不会发生在我身上”,这往往会导致许多人忘记制定一份充足的保险计划来保护他们财富的源头——他们自己!您听说过医生得病、或者理财顾问为自己提交医保索赔申请吗?他们是超人还是他们对疾病和不幸具有“免疫力”?答案是否定的,他们和我们一样,每个人遭遇不幸的机会是一样的,毕竟我们都只是肉体凡胎。这就是拥有保险的重要性。

对20多岁的年轻人来说,刚刚开始工作,您可能没有太多的债务,最多是一些助学贷款,因此对保险可能没有太多需求。然而,这可能是开始了解保险及其重要性的好时机,因为这时父母可能会把为您购买的保单交给您接管。

对于年轻的已婚夫妇来说,会有比较多的财务开支,比如房贷、车贷,甚至是育儿基金。您必须确保有一天如果自己出事,您的配偶不必担心剩下的贷款和您子女的教育经费。在这个阶段,您收入的每一分盈余都应该存入您的退休养老基金,为养老存钱越早越好。

对老年夫妇来说,此时您的子女已经成年,万一您因为疾病或行动不便而无法照顾自己,拥有一项每月固定收益的长期医保产品将显得尤为重要。此外,审核一下您的医保条款也会对您有好处,以确保这些保险条款覆盖到位并且及时更新,因为随着年龄的增长,在健康上的花费也会越来越多。

我们每个人的情况都是不同的,因此有必要与理财顾问聊一聊,协助您了解当前的生活状况、识别您的需求,并确保您没有保障不足或过度投保。

免责声明:以上信息由怡安翰威特咨询(上海)有限公司(注册号310000400102466)提供。由于未考虑可能接收该信息的任何特定人士的具体投资目标、财务状况或特殊需求,因此,上述信息不能代替针对个别情况的具体建议。在您决定购买某投资产品之前,请考虑您的具体投资目标、财务状况或特殊需求,并向理财顾问咨询相关投资产品的适用性。此外,建议您在必要时获取其他专业建议。以上信息出于善意提供,在汇编时确认准确。我司无义务在今后更新相关信息或更正发现的不准确信息。用户应不时查阅各种信息来源,以获取准确的最新一手信息。

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

Author is not a financial advisor, tax professional or legal advisor. The article and its content is for informational purposes only, reader should not construe any such information or other material as legal, tax, investment, financial, or other advice. All information, data, strategies, reports, articles and all other features of this article are provided for informational and educational purposes only and should not be considered or inferred as personalized investment advice. Article may contain errors, and the reader should not make any financial or investment decision based solely on what the reader reads in this article and writing. It shall be reader’s responsibility to perform its own due diligence, and reader must make its own decisions. Be advised and aware that financial and investment decisions involve risk. Author accept no liability whatsoever for any direct or consequential loss arising from any use of author’s writings, products, services, website, or other content, including contents of this article. Reader is responsible for its own investment research and decisions. Reader should seek the advice of a qualified investment advisor and fully understand any and all risks before investing or making any financial decision. Author make no representation that any reader will or is likely to experience results as cited in this article. All results of author’s recommendations are not based on actual investments by author and are based upon a hypothesis, available statistics and surveys which have limitations and do not reflect all components of actual investments. Reader’s actual results may vary based upon many factors. All content and references to third-party sources is provided solely for convenience. This information may be inaccurate, use at your own risk.

By reading this article or any of its contents you agree that neither author nor its employees, shareholders, directors, contractors, affiliates, agents, third party content providers or licensors will be liable for any direct, indirect, incidental or any other type of claim, liability, cost, damage or loss resulting from reader’s use of any of this content. This includes, but is not limited to, loss or injury caused in whole or in part by contingencies beyond our control.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

The content of this article does not constitute individual financial advice.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

The information in this report does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations.

While we have made every attempt to ensure that the information contained in this report has been obtained from reliable sources, Aon is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this report is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Aon be liable to you or anyone else for any decision made or action taken in reliance on the information in this report or for any consequential, special or similar damages, even if advised of the possibility of such damages.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

Den utbredte holdningen om at “dette vil ikke skje med meg” fører til at mange ikke har en god nok plan for å beskytte personen som skaper velstand - seg selv.

Unge voksne som starter på yrkeskarrieren har ikke nødvendigvis store forpliktelser, kanskje det bare dreier seg om studielån, og forsikringsbehovet virker derfor irrelevant. Men dette kan være et gunstig tidspunkt til å sette seg inn i hva forsikring er og hvor stor betydning en forsikringsordning kan få for livet ditt.

Nygifte par kan ha økende økonomiske forpliktelser, som f.eks. boliglån, billån, og planlegger kanskje å få barn. En livsforsikring sørger for at gjenlevende ektefelle ikke trenger å bekymre seg for boliglån og utgiftene som følger med en familie. Dekninger ved uførhet sikrer deg i en situasjon hvor inntekten går ned. Du kan for eksempel bruke det økonomiske overskuddet i denne livsfasen til å starte tidlig med egen pensjonssparing.

Vi har alle ulike behov, og du kan gjøre klokt i å tenke gjennom din nåværende livssituasjon og dine behov, og spørre deg selv om visse forsikringer er blitt overflødige.

De algemene overtuiging "het zal mij niet overkomen" resulteert er vaak in dat veel mensen nalaten om een geschikt plan op te stellen om precies datgene te beschermen dat het vermogen genereert - hen zelf!

Voor twintigers die net zijn begonnen met werken, heb je al dan niet veel verplichtingen zoals een studielening, daarom lijkt de behoefte aan verzekering misschien niet relevant. Het kan echter een goed moment zijn om een paar dingen te leren over verzekering en de relevantie ervan, aangezien dit de tijd is dat ouders polissen doorgeven die ze hebben gekocht om door jou over te laten nemen.

Voor jonge echtparen is er een verhoogde financiële verplichting, zoals hypotheekleningen, autoleningen en zelfs gezinsplanning. Ervoor zorgen dat de langstlevende echtgenoot zich geen zorgen hoeft te maken over de resterende hypotheek en dat het onderwijs van je kinderen jouw prioriteit wordt. Elk surplus dat je in dit stadium zou hebben, moet bijdragen aan je pensioenplanning, aangezien het altijd goed is om vroeg te beginnen.

Voor oudere koppels, als je kinderen volwassen zijn, is de behoefte aan langdurige zorg die een vast maandelijks voordeel biedt als je niet in staat bent om voor jezelf te zorgen vanwege ziekte of handicap, relevanter. Daarnaast is het ook goed om je medische polissen te herzien om er zeker van te zijn dat die up-to-date zijn, aangezien de uitgaven voor gezondheid met je leeftijd zullen toenemen.

Ieder van ons is anders, daarom is het nodig om je huidige levenssituatie te begrijpen, je behoeften te identificeren en ervoor te zorgen dat je niet onder- of oververzekerd bent.

Den almindelige antagelse om, at "det sker ikke for mig", medfører ofte, at mange folk undlader at have en tilstrækkelig plan på plads til at beskytte lige præcis det, der opbygger en formue – dem selv!

Folk i 20'erne, der lige er begyndt at arbejde, har måske eller måske ikke passiver såsom studiegæld, og derfor virker behovet for forsikring måske ikke nær så aktuelt. Det kan dog godt være en god tid at begynde at lære et og andet om forsikringer og deres relevans, da det netop er på dette tidspunkt, at forældre kan videregive de policer, de har købt for dig, så du overtager dem.

For unge nygifte er der en øget økonomisk binding såsom huslån, billån og endda familieplanlægning. Det bliver din prioritet at sikre dig, at din overlevende ægtefælle ikke har noget at bekymre sig vedrørende tilbageværende realkreditlån, og at dine børns uddannelse opprioriteres. Ethvert overskud på dette tidspunkt bør bidrage til din pensionsplanlægning, og det er altid en god idé at starte tidligt.

For ældre par med voksne børn er behovet for langtidspleje, der giver en fast månedlig understøttelse, hvis du ikke kan passe på dig selv på grund af sygdom eller handicap, mere relevant. Derudover er det også en god idé, at du gennemser dine sygesikringspolicer for at sikre, at de er gyldige og opdaterede, da udgifterne til helbredet kommer til at stige med alderen.

Vi er alle forskellige, og derfor er det nødvendigt at forstå din nuværende livssituation, identificere dine behov og sikre dig, at du ikke er over- eller underforsikret.

Η συνήθης αντίληψη του «δεν θα συμβεί σε εμένα» ωθεί συχνά πολλά άτομα να παραμελούν την κατάρτιση ενός σχεδίου που θα προστατεύσει επαρκώς τον μοναδικό συντελεστή δημιουργίας πλούτου: τον εαυτό τους!

Εάν διανύετε τη δεύτερη δεκαετία της ζωής σας και μόλις έχετε ξεκινήσει να εργάζεστε, ενδέχεται να έχετε ή να μην έχετε υποχρεώσεις, όπως το φοιτητικό δάνειο, και, ως εκ τούτου, η ανάγκη για ασφάλιση μπορεί να φαίνεται ότι δεν σας αφορά. Εντούτοις, ίσως είναι η κατάλληλη στιγμή για να αρχίσετε να μαθαίνετε μερικά πράγματα για την ασφάλιση και τη σχέση της με εσάς, καθώς τώρα οι γονείς ενδέχεται να σας παραχωρούν τη διαχείριση ασφαλιστηρίων συμβολαίων που είχαν αγοράσει στο παρελθόν.

Όσον αφορά τα παντρεμένα νεαρά ζευγάρια, υπάρχουν αυξημένες οικονομικές δεσμεύσεις, όπως τα ενυπόθηκα δάνεια για αγορά σπιτιού, τα δάνεια για αγορά αυτοκινήτου, ακόμα και ο οικογενειακός προγραμματισμός. Το να διασφαλιστεί ότι ο επιζών σύζυγος δεν θα χρειάζεται να ανησυχεί για το υπόλοιπο της υποθήκης και την εκπαίδευση των παιδιών γίνεται προτεραιότητά σας. Κάθε περίσσευμα χρημάτων που μπορεί να έχετε σε αυτή τη φάση θα πρέπει να διοχετεύεται στον σχεδιασμό της συνταξιοδότησής σας, καθώς είναι καλή ιδέα να ξεκινάτε από νωρίς.

Όσον αφορά τα ζευγάρια μεγαλύτερης ηλικίας, με ενήλικα πλέον παιδιά, η ανάγκη για μακροπρόθεσμη φροντίδα που παρέχει σταθερό μηνιαίο επίδομα σε περίπτωση που δεν μπορείτε να φροντίσετε τον εαυτό σας λόγω ασθένειας ή αναπηρίας σας αφορά περισσότερο από ποτέ. Επιπλέον, καλό είναι να εξετάζετε τα ασφαλιστήρια συμβόλαια ιατρικής κάλυψής σας για να διασφαλίζετε ότι ισχύουν και είναι ενημερωμένα, καθώς οι δαπάνες για την υγεία αυξάνονται ανάλογα με την ηλικία.

Ο καθένας μας είναι διαφορετικός και, ως εκ τούτου, είναι αναγκαίο να κατανοήσετε την τρέχουσα κατάσταση της ζωής σας, προσδιορίζοντας τις ανάγκες σας και διασφαλίζοντας ότι ασφάλισή σας δεν είναι ανεπαρκής ούτε υπερβολική.

La creencia común de que una cosa concreta «no va a sucederle a uno» suele hacer que mucha gente se olvide de proteger suficientemente aquello que más riqueza genera: ¡ellos mismos!

Las personas que rondan la veintena y que acaban de comenzar a trabajar no suelen tener demasiado cargas y, por tanto, los seguros les parecen irrelevantes. Sin embargo, esta puede ser una buena edad para a aprender varias cosas sobre los seguros y su importancia, ya que es justo el momento en el que sus padres podrían transferirles pólizas que contrataron en su día para que comiencen a hacerse cargo de sus primas.

En el caso de las parejas jóvenes recién casadas, nos encontramos también con el importante compromiso financiero que suponen las hipotecas, los préstamos para la adquisición de vehículos e incluso la planificación familiar. En estos casos, asegurarse de que, en caso de fallecimiento de uno de los cónyuges, el superviviente no tiene que preocuparse por asumir solo la deuda pendiente de la hipoteca o la educación de los niños se convierte en la principal prioridad. Por tanto, cualquier excedente del que se disponga en esta fase debería destinarse a la planificación de la jubilación, ya que conviene comenzar lo antes posible.

En el caso de las parejas de edad avanzada en las que los hijos ya se han emancipado, será más relevante satisfacer la necesidad de disponer de un servicio de atención a largo plazo por si uno de los cónyuges no fuese capaz de valerse solo como consecuencia de una enfermedad o discapacidad. Además, sería conveniente revisar las pólizas de seguro médico a fin de garantizar que se dispone de ellas y que se encuentran correctamente actualizadas, ya que el gasto en atención sanitaria aumenta con la edad.

Cada persona es distinta y, por tanto, es necesario que entienda su situación vital particular, identifique sus necesidades y se asegure de no estar infraasegurado ni sobreasegurado en ningún momento.

Az elterjedt hiedelem, hogy „velem nem történhet meg” gyakran azt eredményezi, hogy sok embernek nincs megfelelő terve arra, hogy megvédje pont azt a dolgot, amely a vagyont megteremti – önmagát!

Azoknak, akik a húszas éveikben járnak, és éppen most kezdtek el dolgozni, lehet hogy van, de az is lehet, hogy nincs semmilyen kötelezettségük, mint például a diákhitel, így a biztosítás szükségessége nem tűnhet lényegesnek. Azonban ez jó időpont lehet arra, hogy elkezdjünk megtanulni egyet s mást a biztosításról és annak fontosságáról, ugyanis ez az az idő, amikor a szülők átadhatják azokat a biztosítási kötvényeket, amelyeket azért kötöttek, hogy átvedd őket.

A fiatal házaspároknak fokozott pénzügyi kötelezettséggel kell számolni, mint például a lakás jelzáloghitele, autóhitel vagy akár a családtervezés. Prioritássá válik számodra annak biztosítása, hogy a túlélő párodnak ne kelljen aggódnia a fennmaradó jelzálog és a gyermekek taníttatása miatt. Minden esetleges fennmaradó összeget ezen a ponton a nyugdíjtervezésedre kell fordítani, mivel mindig jó korán elkezdeni.

Idősebb pároknak, akiknek a gyermekei már felnőttek, fontosabbá válik a hosszú távú gondoskodás igénye, amely fix havi hasznot biztosít, ha nem képesek gondoskodni magukról betegség vagy rokkantság miatt. Továbbá érdemes lehet áttekinteni az egészségügyi biztosításaidat annak érdekében, hogy biztosítsd, megvannak és naprakészek, ugyanis az egészségügyi kiadások növekszenek az életkor előrehaladtával.

Mindannyian különbözőek vagyunk, ezért szükséges megérteni az aktuális élethelyzeted, azonosítani a szükségleteid, és gondoskodni arról, hogy ne legyél alul- vagy túlbiztosítva.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have any liabilities such as a student loan, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

The content of this article does not constitute individual financial advice.

L’idée très répandue que cela n’arrive qu’aux autres fait qu’un grand nombre de personnes ne sont souvent pas assez prévoyantes pour protéger LA chose qui génère de la richesse : elles-mêmes !

Les personnes d’une vingtaine d’années qui commencent juste à travailler peuvent avoir, ou pas, des dettes, comme un prêt étudiant, par conséquent, la nécessité d’avoir une assurance peut ne pas leur sembler opportune. Pourtant, ça pourrait être le moment idéal pour commencer à se renseigner sur les assurances et leur pertinence. En effet, les parents ayant souscrit à des politiques d’assurance au nom de leurs enfants pourrait choisir ce moment-là pour les leur transférer.

Chez les jeunes mariés, on observe un plus grand engagement financier, comme des emprunts immobiliers, des prêts automobile, et des projets de fonder une famille. Faire en sorte que le conjoint survivant n’ait pas à s’inquiéter du remboursement du prêt immobilier ni du coût de l’éducation des enfants devient alors votre priorité. Tout excédent que vous pouvez avoir à ce stade devrait être placé pour planifier votre retraite, car il est toujours judicieux de commencer tôt.

Les couples de personnes âgées, dont les enfants sont adultes, seront plutôt préoccupés par la nécessité d’avoir des soins à long terme sous forme de prestations mensuelles fixes en cas de perte d’autonomie suite à une maladie ou à un handicap. En outre, il serait également bon de passer en revue vos mutuelles d’assurance maladie afin de vous assurer qu’elles sont bien en place et à jour car les dépenses de santé ne feront qu’augmenter avec l’âge.

Nous sommes tous différents, d’où la nécessité de comprendre votre situation actuelle, d’identifier vos besoins et de veiller à avoir les assurances adéquates en place.

„Mir passiert das nicht.“ – Diese weitverbreitete Überzeugung führt dazu, dass viele Menschen es versäumen, das zu schützen, was ihren Besitz generiert – sich selbst!

Wenn Sie zur Gruppe der 20- bis 30-Jährigen gehören und gerade erst ins Berufsleben eingestiegen sind, haben Sie vielleicht keine oder nur geringe Verpflichtungen, wie zum Beispiel ein Studiendarlehen. In diesem Fall sehen Sie für sich womöglich keine Notwendigkeit für Versicherungen. Trotzdem kann dies ein geeigneter Zeitpunkt sein, um sich damit auseinanderzusetzen und das eine oder andere zum Thema Versicherungen in Erfahrung zu bringen. Denn dies ist oft auch die Zeit, in der Eltern Versicherungspolicen an Sie übergeben, die sie in Ihrem Namen abgeschlossen haben und die Sie nun weiterführen sollen.

Auf jungverheiratete Paare kommen vermehrt finanzielle Verpflichtungen zu, wie zum Beispiel Hypothekenkredite, Autokredite und die Gründung einer Familie, Die Absicherung Ihrer Hinterbliebenen für den Fall Ihres Todes sollte höchste Priorität haben, damit Ihr Ehepartner sich nicht um die Hypothek und die Ausbildung der Kinder sorgen muss. Falls Sie in diesem Lebensabschnitt Geld übrig haben, sollten Sie dieses in Ihre Altersvorsorge stecken, denn je früher Sie damit anfangen, desto besser.

Für ältere Ehepaare, deren Kinder bereits erwachsen sind, rückt die Notwendigkeit einer Pflegeversicherung in den Vordergrund, die ihnen einen festen monatlichen Betrag auszahlt, falls sie aufgrund von Krankheit oder Behinderung nicht mehr selbst für sich sorgen können. Darüber hinaus ist die Überprüfung Ihrer Krankenversicherungen empfehlenswert, damit Sie sicherstellen können, dass sie gültig und auf dem neuesten Stand sind, da die Gesundheitsausgaben mit zunehmendem Alter steigen.

Jeder von uns ist anders. Daher ist es notwendig, dass Sie Ihre derzeitigen Lebensumstände verstehen, Ihre Bedürfnisse ermitteln und sicherstellen, dass Sie weder unter- noch überversichert sind.

La convinzione comune secondo cui “non succederà a me” spesso porta le persone a non avere un piano sufficiente a proteggere l’elemento cruciale che genera ricchezza: se stessi!

Se sei un ventenne che ha appena iniziato a lavorare, puoi avere o non avere molte responsabilità, come dei prestiti scolastici, quindi la necessità di un’assicurazione potrebbe non sembrare pertinente. Tuttavia, potrebbe essere un buon momento per iniziare ad imparare un paio di cose sulle assicurazioni e la loro rilevanza, in quanto questo potrebbe essere il momento in cui i genitori trasferiscono a te le polizze che hanno contratto per il tuo subentro.

Nel caso di giovani coppie di coniugi, sussiste un maggiore impegno finanziario, come mutui per la casa o per l’auto, ed anche una pianificazione familiare. Assicurarsi che il coniuge superstite non si debba preoccupare del prestito rimanente e dell'istruzione dei figli diventa una priorità. Qualsiasi eccedenza che si possa vantare a questo punto, dovrebbe contribuire al tuo piano pensionistico visto che è sempre bene iniziare il prima possibile.

Per le coppie più mature, con figli ormai grandi, diventa più importante la necessità di un'assistenza a lungo termine che offra un’indennità fissa mensile, nel caso in cui non si sia autosufficienti a causa di una patologia e di una disabilità. Inoltre, sarebbe anche opportuno riesaminare le polizze mediche per assicurarsi che siano valide ed aggiornate, visto che invecchiando le spese sanitarie aumentano.

Ognuno di noi è diverso, quindi è necessario capire qual è la propria attuale situazione, identificando le proprie esigenze e accertandosi di non essere né troppo assicurati, e né troppo poco.

L’idée très répandue que cela n’arrive qu’aux autres fait qu’un grand nombre de personnes ne sont souvent pas assez prévoyantes pour protéger LA chose qui génère de la richesse : elles-mêmes !

Les personnes d’une vingtaine d’années qui commencent juste à travailler peuvent avoir, ou pas, des dettes, comme un prêt étudiant, par conséquent, la nécessité d’avoir une assurance peut ne pas leur sembler opportune. Pourtant, ça pourrait être le moment idéal pour commencer à se renseigner sur les assurances et leur pertinence. En effet, les parents ayant souscrit à des politiques d’assurance au nom de leurs enfants pourrait choisir ce moment-là pour les leur transférer.

Chez les jeunes mariés, on observe un plus grand engagement financier, comme des emprunts immobiliers, des prêts automobile, et des projets de fonder une famille. Faire en sorte que le conjoint survivant n’ait pas à s’inquiéter du remboursement du prêt immobilier ni du coût de l’éducation des enfants devient alors votre priorité. Tout excédent que vous pouvez avoir à ce stade devrait être placé pour planifier votre retraite, car il est toujours judicieux de commencer tôt.

Les couples de personnes âgées, dont les enfants sont adultes, seront plutôt préoccupés par la nécessité d’avoir des soins à long terme sous forme de prestations mensuelles fixes en cas de perte d’autonomie suite à une maladie ou à un handicap. En outre, il serait également bon de passer en revue vos mutuelles d’assurance maladie afin de vous assurer qu’elles sont bien en place et à jour car les dépenses de santé ne feront qu’augmenter avec l’âge.

Nous sommes tous différents, d’où la nécessité de comprendre votre situation actuelle, d’identifier vos besoins et de veiller à avoir les assurances adéquates en place.

La convinzione comune secondo cui “non succederà a me” spesso porta le persone a non avere un piano sufficiente a proteggere l’elemento cruciale che genera ricchezza: se stessi!

Se sei un ventenne che ha appena iniziato a lavorare, puoi avere o non avere molte responsabilità, come dei prestiti scolastici, quindi la necessità di un’assicurazione potrebbe non sembrare pertinente. Tuttavia, potrebbe essere un buon momento per iniziare ad imparare un paio di cose sulle assicurazioni e la loro rilevanza, in quanto questo potrebbe essere il momento in cui i genitori trasferiscono a te le polizze che hanno contratto per il tuo subentro.

Nel caso di giovani coppie di coniugi, sussiste un maggiore impegno finanziario, come mutui per la casa o per l’auto, ed anche una pianificazione familiare. Assicurarsi che il coniuge superstite non si debba preoccupare del prestito rimanente e dell'istruzione dei figli diventa una priorità. Qualsiasi eccedenza che si possa vantare a questo punto, dovrebbe contribuire al tuo piano pensionistico visto che è sempre bene iniziare il prima possibile.

Per le coppie più mature, con figli ormai grandi, diventa più importante la necessità di un'assistenza a lungo termine che offra un’indennità fissa mensile, nel caso in cui non si sia autosufficienti a causa di una patologia e di una disabilità. Inoltre, sarebbe anche opportuno riesaminare le polizze mediche per assicurarsi che siano valide ed aggiornate, visto che invecchiando le spese sanitarie aumentano.

Ognuno di noi è diverso, quindi è necessario capire qual è la propria attuale situazione, identificando le proprie esigenze e accertandosi di non essere né troppo assicurati, e né troppo poco.

„Mir passiert das nicht.“ – Diese weitverbreitete Überzeugung führt dazu, dass viele Menschen es versäumen, das zu schützen, was ihren Besitz generiert – sich selbst!

Wenn Sie zur Gruppe der 20- bis 30-Jährigen gehören und gerade erst ins Berufsleben eingestiegen sind, haben Sie vielleicht keine oder nur geringe Verpflichtungen, wie zum Beispiel ein Studiendarlehen. In diesem Fall sehen Sie für sich womöglich keine Notwendigkeit für Versicherungen. Trotzdem kann dies ein geeigneter Zeitpunkt sein, um sich damit auseinanderzusetzen und das eine oder andere zum Thema Versicherungen in Erfahrung zu bringen. Denn dies ist oft auch die Zeit, in der Eltern Versicherungspolicen an Sie übergeben, die sie in Ihrem Namen abgeschlossen haben und die Sie nun weiterführen sollen.

Auf jungverheiratete Paare kommen vermehrt finanzielle Verpflichtungen zu, wie zum Beispiel Hypothekenkredite, Autokredite und die Gründung einer Familie, Die Absicherung Ihrer Hinterbliebenen für den Fall Ihres Todes sollte höchste Priorität haben, damit Ihr Ehepartner sich nicht um die Hypothek und die Ausbildung der Kinder sorgen muss. Falls Sie in diesem Lebensabschnitt Geld übrig haben, sollten Sie dieses in Ihre Altersvorsorge stecken, denn je früher Sie damit anfangen, desto besser.

Für ältere Ehepaare, deren Kinder bereits erwachsen sind, rückt die Notwendigkeit einer Pflegeversicherung in den Vordergrund, die ihnen einen festen monatlichen Betrag auszahlt, falls sie aufgrund von Krankheit oder Behinderung nicht mehr selbst für sich sorgen können. Darüber hinaus ist die Überprüfung Ihrer Krankenversicherungen empfehlenswert, damit Sie sicherstellen können, dass sie gültig und auf dem neuesten Stand sind, da die Gesundheitsausgaben mit zunehmendem Alter steigen.

Jeder von uns ist anders. Daher ist es notwendig, dass Sie Ihre derzeitigen Lebensumstände verstehen, Ihre Bedürfnisse ermitteln und sicherstellen, dass Sie weder unter- noch überversichert sind.

“Benim başıma gelmeyeceğine” dair yaygın inanç, çoğu insanın serveti yaratan şeyi korumak için yeterli bir plana sahip olmayı ihmal etmesine neden oluyor!

20'li yaşlarında çalışmaya yeni başlayanlar için, öğrenci kredileri gibi çok fazla yükümlülüğünüz olabilir veya olmayabilir, bu nedenle sigorta ihtiyacı anlamlı görünmeyebilir. Bununla birlikte, sigorta ile ilgili bir iki şey öğrenmeye başlamak için iyi bir zaman olabilir, çünkü bu aynı zamanda, ebeveynlerin sizin için satin aldığı poliçeleri size devretme zamandır.

. Evli genç çiftler için ev kredileri, taşıt kredileri gibi finansal taahhütler artmaktadır. Hayatta kalan eşinizin kalan ev kredi borcu konusunda endişelenmesine gerek olmaması ve çocuklarınızın eğitimine öncelik vermesi gerekir. Bu aşamada ne kadar erken olduğuna bakmaksızın, sahip olabileceğiniz her ilave geliri emeklilik planınız kapsamında yatırıma yönlendirebilirsiniz.

Çocukları büyümüş yaşlı bir çift olarak sizin, hastalık veya sakatlık nedeniyle kendinize bakamamanız durumda devreyegiren ve aylık sabit gelir sağlayan bir sigorta ürününe daha çok ihtiyacınız olacaktır. Buna ek olarak, sağlık poliçenizi kontrol etmeniz ve ilerleyen yaşla birlikte artan sağlık giderlerinizi karşılayacağınan emin olmanız gerekir.

Her birimiz farklıyız, bu nedenle mevcut yaşam şartlarınızı anlamanız, ihtiyaçlarınızı tanımlamanız ve yetersiz ya da aşırı sigortalı olmadığınızdan emin olmanız gerekir.

有的人常常認為「這樣的意外不會發生在我身上」而忽視了制訂充分的計劃,來保護能夠為我們最主要的財富來源 – 也就是你、我!

對於剛步入職場、20幾歲的年輕人,您可能有負擔債務 (如:學生貸款),也可能沒有債務。看似不需要保險的年紀,但正是開始學習有關保險及相關知識的好時機。因為這時候父母可能將幼齡時期購買的保險、保單轉交給您接手。

對於年輕夫妻而言,財務負擔逐漸增加 (如:房屋貸款、汽車貸款、甚至是計劃生育)。確保您的配偶不必擔心剩餘的貸款還不完,並且以孩子的教育為當務之急的前提下;在這個階段中,若擁有任何的結餘,都建議存到您的退休儲蓄計劃中,因為儘早準備總是好事。

對於老年夫妻而言,若孩子已經成年,需要的是長期照護的保障。如果因為疾病、殘疾而無法自理,則將會需要每個月有筆固定的收入來源。除此之外,對於醫療保單進行檢視也是一件好事,確保這些保單條款與內容已經到位,並且是最新的。隨著年齡的增加,在醫療方面的支出也會不斷增加。

我們每個人都不同,因此必須了解您目前的生活狀況,確定您的需求並確保沒有不足或過度保險。

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, could be used to contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

The content of this article does not constitute individual financial advice. Aon can’t provide personalised investment advice or make personalised recommendations – we therefore suggest that you speak to an authorised financial adviser if you want to understand any of these concepts in the context of your personal situation.

The common belief that “it won’t happen to me” often results in many people neglecting to have a sufficient plan to protect the very thing that generates the wealth – themselves!

For those in their 20s who have just started working, you may or may not have much liabilities such as student loans, therefore the need for insurance might not seem relevant. However, it might be a good time to start learning a thing or two about insurance and its relevance as this is the time parents might be passing on policies that they have bought for you to take over.

For young married couples, there is an increased financial commitment such as home mortgage loans, car loans and even family planning. Ensuring that your surviving spouse does not have to worry about the remaining mortgage and your children’s education becomes your priority. Any surplus that you can have at this stage, should contribute to your retirement planning as it is always good to start early.

For elderly couples, where your children are grown-ups, the need for long-term care that provides a fixed monthly benefit if you are unable to take care of yourself due to sickness or disability will be more relevant. In addition, it will also be good for you to review your medical policies to ensure that they are in place and up to date as spending on health with increase with age.

Every one of us is different, hence there is a need to understand your current life situation, identifying your needs and to ensure that you are not under or over-insured.

Disclaimer: The information is brought to you by Aon Vietnam Limited with its Establishment and Operation License No. 26/GP-KDBH . Aon Vietnam Limited is a licensed insurance broker regulated by the Ministry of Finance in Vietnam. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information

Niềm tin phổ biến “mọi chuyện sẽ không xảy ra với tôi”, thường khiến nhiều người quên lãng kế hoạch bảo vệ chính thứ tạo ra sự giàu có đó – là bản thân họ!

Đối với những người ở độ tuổi 20 mới bắt đầu đi làm, bạn có thể có hoặc không có nhiều khoản nợ như khoản vay sinh viên, do đó nhu cầu bảo hiểm có vẻ không phù hợp. Tuy nhiên, đây có thể là thời điểm tốt để bắt đầu tìm hiểu một vài điều về bảo hiểm và sự liên quan của nó vì đây là thời gian cha mẹ bạn có thể giao lại các chính sách bảo hiểm họ đã mua cho bạn.

Đối với các cặp vợ chồng trẻ, có một cam kết tài chính như cho vay thế chấp nhà, vay mua ô tô và thậm chí là kế hoạch gia đình. Đảm bảo rằng người phối ngẫu còn sống của bạn không phải lo lắng về khoản thế chấp còn lại và giáo dục con cái trở thành ưu tiên của bạn. Bất kỳ khoản thặng dư nào có thể có trong giai đoạn này, nên đóng góp vào kế hoạch nghỉ hưu của bạn vì bắt đầu sớm luôn luôn tốt.

Đối với các cặp vợ chồng già, con cái của bạn đã trưởng thành, nhu cầu chăm sóc dài hạn mang lại lợi ích cố định hàng tháng nếu bạn không thể tự chăm sóc bản thân do bệnh tật hoặc khuyết tật sẽ phù hợp hơn. Ngoài ra, cũng rất tốt khi xem xét các chính sách y tế để đảm bảo rằng chúng được thực hiện và cập nhật khi chi tiêu cho sức khỏe tăng theo tuổi.

Mỗi người trong chúng ta đều khác nhau, do đó cần phải hiểu tình hình cuộc sống hiện tại của bạn, xác định nhu cầu của bạn và đảm bảo rằng không phải bạn chưa có đủ bảo hiểm hoặc bảo hiểm quá mức.

Tuyên bố miễn trừ trách nhiệm: Thông tin này được cung cấp bởi Công ty TNHH Aon Việt Nam với Giấy phép Thành lập và Hoạt động số 26/ GP-KDBH. Công ty TNHH Aon Việt Nam là công ty môi giới bảo hiểm được cấp giấy phép dưới sự quản lý của Bộ Tài chính tại Việt Nam. Các thông tin này không tính đến các mục tiêu đầu tư cụ thể, tình hình tài chính hoặc nhu cầu riêng biệt của bất kỳ đối tượng cụ thể nào nhận được tài liệu này. Theo đó, bạn không nên dựa vào hoặc coi tài liệu này như một phương thức thay thế cho sự tư vấn riêng biệt liên quan đến các tình huống cụ thể. Vui lòng tìm kiếm sự tư vấn từ chuyên gia cố vấn tài chính về sự phù hợp của bất kỳ sản phẩm đầu tư nào có tính đến các mục tiêu đầu tư cụ thể, tình hình tài chính hoặc nhu cầu riêng biệt của bạn trước khi bạn cam kết mua sản phẩm đầu tư. Bạn cũng nên có được sự tư vấn chuyên biệt khác khi cần thiết. Thông tin này được cung cấp dựa trên sự trung thực và được cho là chính xác vào thời điểm biên soạn. Chúng tôi không có nghĩa vụ phải cập nhật các tài liệu hoặc sửa chữa bất kỳ thông tin không chính xác nào là những thông tin được làm rõ sau này. Bạn luôn cần phải tham khảo các nguồn thông tin chính hoặc các thông tin chính xác hơn hoặc cập nhật hơn.

Managing financial risk is important to successful financial planning. Financial risk comes in many forms … and is sometimes not recognizable as financial risk. Sure, the first thing one thinks about regarding financial risk is losing money on an investment. But financial risk goes way beyond that. If an injury causes you to lose income, that is financial risk. If you lose a lawsuit and have monetary damages against you, that is financial risk. If a family "bread winner" dies or becomes disabled, that is financial risk. Anything "unexpected" that has an adverse effect on your financial goals is financial risk.

How you manage risk is a financial planning concern of major importance. For hundreds of years, people have used insurance as a means to help manage financial risk. You need to consider financial risk and the ways to handle it and how to avoid financial disaster.

The Purpose of Insurance

We live in a world full of risk. Risk is the possibility of loss. Sometimes the loss is trivial, while other times it causes major personal and financial hardship. There is no way to completely eliminate all risk, but there are ways to avoid, minimize, or protect oneself from risk. When risk is low, or the cost is not too high, one can assume risk. When it is too costly to assume risk, we need other ways to manage it.

The purpose of insurance is to provide financial relief due to catastrophic losses. One can determine the mathematical probability of risk occurring and the financial risk at stake.

Some history, first

Insurance was invented to help merchants minimize financial losses from shipwrecks when moving goods across the ocean in sailing ships. It works on a mathematical principle based on "the law of large numbers."

Shippers noticed that while some merchandise was lost due to shipwrecks, not all ships were lost. If all shippers anted money into a pool to cover the losses of the shippers whose merchandise was lost, then they all had a fair chance of not being wiped out, if disaster befell them. Odds-makers were able to compute the probability of losses to determine how much each shipper needed to pay in order to cover the probable losses, based on the cost of each shipment. Of course, the odds-makers and investors would receive compensation for their services, and they factored that into the premiums, too.

The role of risk

Modern insurance works in the same way. Regardless of the risk, one can determine the mathematical probability of it occurring and the financial risk at stake. Anyone who owns an automobile knows that he or she is required to have automobile insurance to cover the risk of damage to someone else's property. With many years of statistics on automobile damage costs, insurers are able to determine the amount of premium necessary to provide benefits to insure automobile owners. Using the same principles, one can buy insurance to minimize financial loss due to accident, natural disaster, legal liability, illness, disability, and even death.

Insurance is a tool used to help manage financial risk. Financial risk can take many forms. There are risks to our investments, liabilities for our actions, and risks to our ability to earn income. There is insurance to manage all these risks. We encourage you to read articles on specific types of insurance to get in-depth coverage of each specific kind.

Special forms of insurance are available to cover almost any other financial risks. For example, there is unemployment insurance, investment insurance, and dismemberment insurance (for loss of a body part). Some high-fashion models are even insured against loss of income due to loss of their good looks. Premiums for such insurance are also based upon the likelihood of an event occurring and the amount of benefits to be paid.

The Role of Risk in Insurance

Over many centuries, the purpose of insurance has remained the same: to provide financial relief due to catastrophic losses. Money from many people is pooled to pay for losses incurred by a few.

There are several ways to manage risk. You can avoid risk, share it, or transfer it.

There are other ways to handle risk: avoiding it

Insurance is not the only means of managing risk. One way is to avoid risk. Risk avoidance can lower the financial cost of risk. That is why insurance premiums are lower for persons and businesses that take measures to lower risk. For example, automobile insurance premiums are lower for drivers with good driving records (no accidents and no cited violations of driving laws), and non-smokers pay lower medical insurance and life insurance premiums than do smokers. But it is not always possible to avoid risk, and sometimes, insurance premiums may be too costly.

Sharing risk

Another way to manage risk is to share it with others. Some insurance policies allow you to share the risk in order to get a lower premium. If you can assume a certain amount of financial risk, then the insurance premium on the balance of the risk will be lower. For example, many automobile policies have lower premiums if you take responsibility for a certain dollar amount of liability—known as a deductible. Medical insurance premiums can also be lowered if you have higher deductibles or co-payments.

Transferring risk

Finally, for those who cannot tolerate any financial risk, risk can be transferred to someone else, usually the insurance company, who assumes full responsibility for financial risk. Of course, this method of risk management has the highest premium cost.

Property and Casualty Insurance

Property and casualty insurance defined

Investments in real property and hard assets are at risk for theft or destruction by natural causes, accident, or mischief (generally, acts of war and terrorism are not covered by property and casualty insurance). Property and casualty insurance helps manage these risks. Property and casualty insurance is available in the form of home insurance, automobile insurance, boat insurance, business property insurance, etc.

Property and casualty protects specific assets from many forms of loss.

Coverage details

It protects specific assets from many forms of loss and insures the property owner against liability for damages resulting from the asset's use. The cost of property and casualty insurance is based upon the value of the insured assets and the environment in which the assets are located. For example, auto insurance rates vary depending on the area in which the automobile is located. Communities with high rates of auto theft and accidents will have higher auto insurance rates. Auto insurance also takes driving records and the insured's age into consideration when pricing policies. Some of the types of auto insurance coverage include liability, medical payments coverage (or personal injury protection), comprehensive physical damage, and uninsured/underinsured motorists' collision.

Errors and Omissions, Professional Malpractice Insurance, Professional Liability Insurance

Many occupations and professions risk causing damage to others that can result in financial awards against them. If one were sued for malpractice, this would cause financial hardship when one had to liquidate assets or assign future income to pay the awards. Doctors, lawyers, accountants, financial advisors, construction workers, and anyone else whose occupation can inadvertently cause harm to others or others' property may be liable for financial damages. Financial damages, whether paid from assets, future income, or both, can be daunting and pose a severe financial hardship. There is specific insurance that helps manage these risks arising from one's occupation. Premiums for such insurance are based upon industry statistics and the history of the insured person. Sometimes claims against a person may not be made for years after the occurrence of the action causing the claim, so it is important to know the conditions under which the policy will cover claims.

Health and Long-Term Care Insurance

Health insurance

We all know people who have high medical care costs. Often paid by employer contributions, healthcare insurance is essential to assure an adequate level of medical care. Yet, there are many people who have inadequate or no health care insurance at all. There are many forms of health care insurance programs available, including fee-for-services plans, hospital and medical service plans, and managed care plans (prepaid health plans that provide comprehensive health to members, health maintenance organizations, preferred provider organizations, exclusive provider organizations, and point-of-service plans). Premiums are based upon group statistics and levels of care provided.

Long-term care insurance

With the aging of the population, there is a strong need for long-term care insurance to cover costs of nursing homes and assisted living care for the elderly. For eligible individuals, federal and state-sponsored insurance help defray the high cost of medical care.

Life and Disability Insurance

If a family were to lose its income due to the death or disability of the principal earners, it would face financial hardship. While no one can put a monetary value on human life, one can put a value on his or her earning ability. Life insurance and disability insurance pay benefits to replace lost earnings due to death or disability. The premiums for this insurance are based upon statistics for the age, health, and occupation of the insured, as well as the amount of benefits to be paid. While both life and disability insurance are available through groups, such as employer plans, individuals can buy policies tailored to their specific needs. Life insurance is so versatile that many individuals use it for advanced financial planning purposes, such as retirement planning and savings, as well as for death benefits.

How to Shop for Insurance

Buying insurance should be no different from making any other major purchase, such as a car or house. Before making the purchase, you should determine what features you really need. This is important to assure that you get what you expect at a reasonable cost.

First determine what risk you are managing.

Determine how much of the risk you can assume yourself, in order to keep insurance premiums low.

When comparing two policies, do not let price be the overriding factor.

What to think about

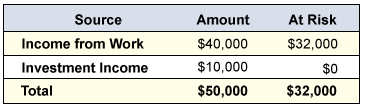

Insurance is a risk management tool. You should first determine what risk you are managing. Also, determine how much of the risk you can assume yourself, in order to keep insurance premiums low. For example, if you bought a house and have a substantial mortgage, you might want to insure the value of the house against loss due to fire, flood, or other catastrophic events since you would be responsible for the mortgage balance even if the house were destroyed. On the other hand, if you bought a jalopy car for a few hundred dollars cash, it might not make sense to insure it against loss, because its value is so low. With tangible assets, it is easy to see the relationship, but with intangibles, it is difficult, but not impossible. If your gross family income were $50,000 per year and you wanted to insure against the risk of loss due to a disability, for example, you would need to determine how much of that income was at risk. The table below shows an example of family income at risk:

Only the income from work is at risk for loss due to disability. After deducting taxes, the net income at risk is only $32,000. This might be the amount of disability insurance to purchase. In shopping for insurance, first determine what you are insuring against and how much insurance you need.

Next, look at the insurance companies

Find the insurance companies that have the kind of insurance you need. Not all insurance companies insure all risks. You will need to find the right insurance companies for the kinds of risks you are insuring against. Some insurance companies handle more than one line of insurance, but they are usually related lines. Property and casualty insurance companies usually provide automobile, homeowner/renter, and personal liability lines of insurance. Life insurance companies usually provide life, accident, and disability insurance. Many agencies try to provide "one stop shopping" by offering several different kinds of insurance; however, you may find it more economical to shop for insurance from companies that specialize in one or two lines only. You may need to find an insurance agent who understands your specific needs and who can direct you to the insurance provider that is best for you. You can purchase insurance directly from some companies, but you need to do your homework first. What you save in commissions may be spent in your time and effort. Some insurance is available only to groups, such as employee groups, unions, professional associations, or religious or fraternal organizations.

What to compare

Compare features, benefits, and premiums. The cost of insurance is more complex than the premium alone. When shopping for insurance, be sure to read the fine print. An insurance policy is a legal contract. The language is exact and definitions are very important. If you do not understand the language, have a trusted advisor explain it to you. When comparing two policies, do not let price be the overriding factor. A more expensive policy may not be better (or worse) than a less expensive one. Some policies may provide different benefits or risk coverage riders (benefits). Be sure the policy you buy provides all the coverage you want and need. Save money by avoiding policy riders you do not want or need.

Most states require insurers and their agents to provide you with an "insurance buyer's guide." Ask for one and read it carefully.

Summary of Insurance

There are many types of insurance to help you manage financial risk, from loss of property to loss of income. Some insurance helps provide cash flow when income and savings are insufficient. You now have a general knowledge of insurance as a risk management tool.

A crença comum de que "não me vai acontecer mim" faz com que muitas vezes as pessoas não se preocupem em ter um plano adequado para proteger aquilo que gera a riqueza, ou seja, elas próprias.

As pessoas na casa dos 20 anos que começaram a trabalhar recentemente podem ou não ter responsabilidades (como um crédito para estudantes) e a necessidade de ter um seguro poderá não parecer relevante. No entanto, poderá ser uma boa altura para começar a aprender uma ou duas coisas sobre seguros e a sua importância: poderá ser a altura em que os pais transferem apólices adquiridas para que os filhos façam a sua gestão.

No caso de recém-casados existe um compromisso financeiro acrescido como, por exemplo, crédito à habitação, crédito automóvel ou ainda planeamento familiar. Torna-se prioritário garantir que o cônjuge sobrevivente não tenha de se preocupar com o restante crédito hipotecário e com a educação dos filhos. Quaisquer valores excedentes que tenha nesta fase devem contribuir para o seu planeamento da reforma, uma vez que é sempre bom começar cedo.

No caso de casais mais velhos, quando os filhos já são adultos, a necessidade de cuidados a longo prazo que representam um valor mensal fixo torna-se ainda mais relevante caso não tenham possibilidade de cuidar de si próprios devido a doença ou incapacidade. Além disso, deverá também verificar os seus seguros de saúde para garantir que estão em vigor e atualizados, uma vez que os gastos com a saúde aumentam com a idade.

Somos todos diferentes e, por isso é necessário compreender a sua situação atual, identificar as suas necessidades e garantir que os seus seguros não pecam por defeito, nem por excesso.

O conteúdo deste artigo não constitui um aconselhamento financeiro individual.