Understanding Pension Saving Restrictions

Select a country below to read the localised content of this article.

Whilst generally saving as much as you can in your pension is a good idea, there are some limits which if breached will mean you will pay more in tax.

Lifetime Allowance

The Lifetime Allowance (LTA) was introduced into pension legislation on 6th April 2006 and is the maximum value of pension benefits an individual can accumulate in their working lifetime before being subject to a further tax charge, in addition to income tax, when taking pension benefits. This additional tax charge is known as the "LTA excess charge".

The LTA was originally set at £1,500,000 with incremental increases for the initial five years, reaching £1.8 million from 2010/11. It remained at this level until reductions were applied in 2012, 2014 and 2016 resulting in an LTA of £1 million from April 2016.

When the final reduction was implemented, it was announced that the LTA will increase annually in line with the Consumer Price Index (CPI) from April 2018 onwards.

It was announced in March 2021 that the LTA will remain at £1,073,100 until the 2025/26 tax year.

Lifetime Allowance Excess Charge

Where benefits are accrued above the value of the LTA, an additional tax charge is levied known as the LTA excess charge. The rate applicable depends upon how this excess is paid to an individual. If the excess is taken as a lump sum the rate applicable is 55%, or 25% if benefits are taken as pension income. However, if taken as income it is also subject to income tax at your marginal rate, resulting in an effective overall rate of approximately 55% (assuming the individual is a higher rate tax payer).

If the Lifetime Allowance has been fully utilised, any benefits accessed after that point can be taken as a Lifetime Allowance excess lump sum. This means that the entire value of any benefits accrued over and above the LTA can be taken as a lump sum payment; however, this would be subject to a 55% tax charge.

Money Purchase Annual Allowance (MPAA)

The Annual Allowance is the amount that can be paid into your pension each year by you, your employer or any third party without you incurring a tax charge.

On 6th April 2015, the Government introduced a lower level of Annual Allowance, called the Money Purchase Annual Allowance (MPAA), for anyone that 'flexibly' accesses pension income. It is designed to discourage people from using new flexible pension rules in order to avoid tax and potentially National Insurance (NI) contributions.

From 6th April 2017, the MPAA reduced from £10,000 to £4,000 a year. So if the MPAA applies to you and if you contribute more to your pension than the MPAA, you will need to pay the relevant annual tax charge to HMRC via self-assessment.

The MPAA does not replace the current Annual Allowance rules (or reduce the normal Annual Allowance) unless you take your pension benefits from a Defined Contribution pension scheme using 'flexibility'.

How do I know if I'm accessing my pension income flexibly?

- The HMRC defines what constitutes taking benefits 'flexibly', known as trigger events and a full definition can be found here: https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm05620

- If you take benefits from a Defined Contribution pension scheme in the following ways, the MPAA is not triggered:

- Buy an annuity that can't reduce the amount it pays

- Only take tax-free cash and no income

- Commencing a scheme pension from a Trust based Defined Contribution scheme

- If you take benefits from a Defined Benefit scheme the MPAA is not triggered.

What happens if I trigger the MPAA by accessing my pension income flexibly?

- The Annual Allowance will still be the primary allowance to consider, however, when a trigger event happens (see 1 above), the new MPAA rules will apply and continue to do so for each subsequent tax year.

- The MPAA will only start to apply from the day after you have taken flexible benefits and so any previous pension savings are not affiliated.

- If you take benefits from a Defined Contribution scheme flexibly while you are still working, you need to calculate how much you need to reduce your total pension contributions by, in order to be under the MPAA. Otherwise, you will need to pay HMRC a tax charge.

Pension Annual Allowance 2021/2022

The Annual Allowance changed for high earners with effect from April 2016. How do you work out if you're affected? And if you are, what action can you take?

The Annual Allowance:

The Annual Allowance is the highest amount you can save towards your pension each year tax-free. It applies to your contributions and your employer's, and to any other pensions you accrue benefits in.

If you go over the Annual Allowance you may have to pay tax on the excess, though you can 'carry forward' any 'unused' allowance from the previous three tax years.

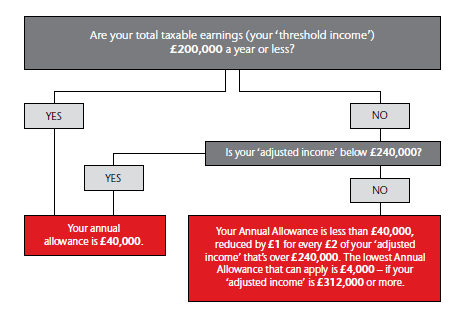

For most people, the Annual Allowance is £40,000 for the 2021/22 tax year. However, a lower, 'tapered' Annual Allowance is applied with effect from 6 April 2021 if your 'adjusted income' is over £240,000.

Pensions and Self-Assessment for Scottish Based Employees

The Self-Assessment process enables individuals to declare to HMRC any additional tax due to be paid; or claim back any tax relief or overpaid tax. With regards to pensions, the self-assessment system is used:

- By intermediate, higher or additional rate tax payers to claim tax relief at their full rate on any contributions made directly to the pension provider where only basic rate tax relief has been received and/or

- To declare any tax due because of exceeding any of HMRC's allowances such as the Lifetime Allowance or Annual Allowance

Who can claim Tax Relief?

Any contributions paid to a pension receive tax relief. The rate of tax relief available is dependent upon the levels of taxable earnings an individual has in the applicable tax year. If you pay basic rate, higher or additional rate tax (20%, 40% or 45% respectively), this is the level of tax relief that is applicable. However, when contributions are paid directly to a pension scheme, either as an employee contribution from net pay or as a payment directly via a Direct Debit, the pension provider will apply tax relief at a rate equivalent to basic rate tax (currently 20%). If an individual pays a higher rate of tax then this additional rate tax can be claimed back via the Self-Assessment process.

Please note: If you are making contributions to your workplace pension by Salary Sacrifice or if you are contributing to a Final Salary Scheme or Occupational Scheme out of gross pay then these deductions are taken from your pay before the application of tax. Consequently, you are receiving tax relief at a rate equivalent to your highest rate of income tax and therefore no further tax relief can, or should, be claimed.

How many years relief can be reclaimed?

Whilst you can only use self-assessment to claim tax relief for the relevant year you are submitting the tax return for, higher or additional rate tax relief can still be claimed up to four years after the end of the relevant tax year the claim is being made for. This is confirmed by HMRC within the self-assessment claims manual and a link can be found here https://www.gov.uk/hmrc-internal-manuals/self-assessment-claims-manual/sacm3035. This is done by contacting your local Tax Office and their details can be found on your latest P60.

How is the additional tax relief calculated?

HMRC will add the value of the contributions made to your basic rate tax threshold. They will then work out how much total tax should have been paid on these contributions.

HMRC will then deduct the tax paid and if you have paid more you will receive the excess back. This will be used to offset any other tax liabilities or repaid to you either as a lump sum or by adjusting your tax code for the current year.

The content of this article does not constitute individual financial advice.

Tax relief on contributions

You may get tax relief on contributions to approved personal pension arrangements.

If you’re a PAYE worker, this relief is generally applied at source by your employer. You can also apply for the relief online at Revenue’s myAccount service. If you’re self-employed, you can apply for tax relief on contributions by using Revenue’s Online Service (ROS).

This relief is more generous as you get older. Since 1 January 2011 you pay PRSI and the Universal Social Charge on your pension contributions.

|

Age |

Amount which qualifies for tax relief |

|

Under 30 years |

15% of net relevant earnings |

|

30 to 39 years |

20% |

|

40 to 49 years |

25% |

|

50 to 54 years |

30% |

|

55 to 59 years |

35% |

|

60 and over |

40% |

The maximum amount also applies to people in certain occupations and professions, irrespective of age where there is a limited earnings span. These occupations include professional athletes.

There is a limit on the earnings that may be taken into account. The limit is €115,000.

You no longer have to buy an annuity with the proceeds of your pension policy, however, you may do so if you wish. This option does not apply in general to occupational pensions, but it may apply to the Additional Voluntary Contributions (AVCs) paid by people in occupational pension schemes.

Lifetime Allowance

Individuals have a maximum lifetime limit on the amount of their retirement benefits from all sources (except State pensions).

The limit (known as the Standard Fund Threshold (SFT)) is a limit or ceiling on the total capital value of pension benefits that an individual can draw from tax-relieved pension arrangements.

From 1 January 2014, the absolute value of the SFT is €2 million. From the same date, the value of a defined benefit differs depending on the age at which the pension is drawn down.

If the aggregate value of your pension arrangements exceeds €2 million, it is possible to apply to Revenue for a Personal Fund Threshold (PFT) certificate in advance of your retirement date.

Taxation of lump sum

There is a limit of €200,000 on the amount of the tax-free retirement lump sum. Lump sum payments above that limit will be taxed as follows:

|

Lump sum taxation rates |

|

|

Amount of lump sum |

Income tax rate |

|

Up to €200,000 |

0% |

|

€200,001 - €500,000 |

20% |

|

Over €500,000 |

Taxpayer's marginal rate |

Transfer between funds

You do not have to remain in the same pension fund. You may transfer funds accumulated with one insurer to another fund with another insurer. Of course, there may be costs involved in doing this.

When you retire, you may opt for the existing annuity arrangements or for the new arrangements. The new arrangements mean that the accumulated fund is your property. You must take your pension not later than your 75th birthday (the previous upper limit was 70).

The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Fiscaal mag u niet onbeperkt pensioen opbouwen. Dat neemt niet weg dat u geen vermogen kunt opbouwen voor extra pensioen. U kunt zelf vermogen gaan opbouwen in de zogenaamde vierde pijler. De vierde (pensioen)pijler valt onder individueel pensioen en heeft geen verplichtingen voor overheid of werkgever. Dit kan een spaar of beleggingsrekening zijn. Ook kunt u zorgen dat uw hypotheek is afgelost op het moment dat u met pensioen gaat. Uw vaste lasten worden hiermee lager. Als u geen hypotheek meer heeft dan kunt u de overwaarde natuurlijk te gelde maken. Doorwerken na de pensioendatum is ook een manier om extra inkomen te verkrijgen.

Meer informatie over vermogen opbouwen kunt u vinden bij het Nibud --> hyperlink https://www.nibud.nl/consumenten/themas/pensioen-vermogen/vermogen

Emekli planınıza yapabildiğinizce yüksek katkı yapmak iyi bir fikirdir ve fazla ödeme yapmanızın sizin için herhangi bir vergi yükü olmayacaktır.

Öte yandan çalışanlar, ödenen katkılarının% 25'I kadar devlet katkısı alacaktır. Bu kazanımın bir tavanı bulunmaktadır. Çalışanlar asgari ücrete kadar yaptıkları katkılara karşılık devlet katkısı alacaklardır. 1.1.2020 itibariyle aylık limit 735,75 TL'dir. Asgari ücret arttıkça bu limit de artmaktadır.

Saving as much as you can in your pension is a good idea, and if you pay more there will not be any tax burden for you.

On the other hand employees will receive a state subsidy of 25% of their paid contributions. There is a ceiling this benefit. It is 25% of minimum wage. It is TRY 735.75 per month as of 1.1.2020. Minimum wage is adjusted annually.

Der findes tre hovedtyper af pensionsopsparinger: Ratepension, livrente og et engangsbeløb. De første to er mest almindelige for arbejdsmarkedspensioner.

Dit pensionsbidrag bliver som standard indbetalt til ratepension, indtil du når den årlige grænse på 57.200 kroner. Alle pensionsbidrag over dette beløb anbringes på en livrente – denne har ingen begrænsninger.

For indbetalinger til både ratepension og livrente udskydes beskatning indtil pensionsalderen, hvor du betaler indkomstskat af dine udbetalinger.

Den tredje mulighed – et engangsbeløb – er ikke så almindelig, hvad angår arbejdsmarkedspensioner, idet den har en årlig grænse på blot 5.300 kroner, hvis du har mere end 5 år til pensionsalderen. Hvis du har mindre end 5 år til pensionsalderen, kan du dog øge dit bidrag med op til 50.200 kroner. For denne pensionstype betaler du indkomstskat, når du indbetaler til opsparingen. Dette betyder også, at du får pensionen udbetalt skattefrit, når du går på pension.

Pembayaran Tunjangan Pensiun:

Tarif pajak final untuk pembayaran pensiun lump-sum dari dana pensiun yang disetujui pemerintah, pembayaran tabungan jaminan hari tua dari BPJS Ketenagakerjaan (program jaminan sosial pekerja) jika dibayarkan dalam waktu dua tahun adalah sebagai berikut:

|

Jumlah (dalam juta Rupiah) |

Pajak Akhir |

|

0-50 |

0% |

|

> 50 |

5% |

Pembayaran dilakukan pada tahun ketiga dan sesudahnya akan dikenakan tarif pajak normal dan dapat diklaim sebagai kredit pajak.

Orang yang bukan penduduk pada umumnya dikenakan pajak pemotongan 20% atas penghasilan yang diterima dari Indonesia (Pasal 26 pemotongan pajak). Namun tarif ini dapat bervariasi tergantung keadaan dan ketentuan perjanjian pajak yang berlaku. Tarif spesifik berlaku untuk penghasilan yang dikenakan pajak final.

Informasi selengkapnya:

https://www.pwc.com/id/en/pocket-tax-book/english/pocket-tax-book-2019.pdf

Informasi ini tidak mempertimbangkan tujuan investasi khusus, kondisi finansial, atau kebutuhan khusus orang tertentu yang mungkin menerima rujukan ini. Oleh karena itu, informasi ini tidak boleh dijadikan dasar atau pengganti nasihat khusus mengenai kondisi seseorang. Silakan meminta saran dari penasihat keuangan mengenai produk investasi yang sesuai dengan mempertimbangkan tujuan investasi, kondisi keuangan, atau kebutuhan khusus sebelum Anda berkomitmen untuk membeli produk investasi apa pun. Anda juga disarankan untuk meminta saran profesional lain jika diperlukan. Informasi ini disediakan dengan itikad baik dan diyakini akurat saat penyusunan. Kami tidak berkewajiban untuk memperbarui materi atau untuk membetulkan ketidakakuratan yang mungkin ditemukan dikemudian hari. Anda sebaiknya selalu menggunakan sumber informasi utama atau yang lebih akurat atau lebih mutakhir.